Because the secured personal loans are supported by equity, they often offer a lowered interest than simply signature loans

Fund can be active financial gadgets to help you reach finally your wants, but they is employed smartly. While you are thinking about borrowing from the bank money, consider carefully your selection cautiously.

Secured finance

A guaranteed mortgage happens when your bring anything since safeguards inside the get back for money your obtain – such as assets, your deposits or other assets. not, banks or any other loan providers can also be allege your own asset for many who default on your loan repayments. Some common types of secured loans is actually debt consolidating money, family security finance and next mortgages.

Pledges and you can sureties

If for example the lender is being unsure of about your capacity to repay this new financing, they may be able require a good surety, otherwise be sure. A surety is a lawfully binding contract one a 3rd-class (always one or a friends) welcomes obligation toward loan if you fail to build your money. It 3rd party is named a surety or guarantor.

For those who fall behind toward repayments, the lender has the to demand that the surety often make up the brand new lost repayments otherwise pay the borrowed funds in full. Should your surety fails to meet up with the obligations, the lender has the directly to get lawsuit contrary to the surety.

Signature loans

Which have a personal bank loan, your borrow money instead of adding guarantee. Rates getting unsecured loans is greater than secured finance once the you are not offering any security to the lender. Your credit score could be taken into account when you apply for a personal loan, and your get ples regarding signature loans become playing cards, signature loans, income tax fund and you can overdraft.

Fixed against. drifting attention-rates money

Floating-price loanA loan with an intention rates that increases and you will drops – or floats – having field interest levels. The attention costs for many drifting-speed financing change in accordance with the perfect rate.

Fixed-speed loanA loan which have focus you to stays repaired into the loan’s entire name, aside from business rate of interest fluctuations. Some people choose these mortgage because their money often remain an equivalent in the period.

Interest rates out of loan affairs

Desire is usually the chief price of taking out fully financing. Always make sure you are sure that the method of interest calculation that the lending company use just before borrow.

According to kind of loans, you can find different popular base on what interest percentage is calculated in the business, particularly monthly flat fee otherwise yearly rate for personal instalment money and you will each day otherwise monthly material price to own mastercard the harmony.

The price of financing doesn’t only were attention. There will also be almost every other fees and you will charge, instance approaching fees, annual charge, with the financing. Therefore we need to believe both the attract pricing therefore the related costs understand the complete cost of borrowing.

When you look at the Hong-kong, authorized organizations beneath the oversight of your Hong kong Financial Expert must county the Annualised Percentage Price (APR) regarding signature loans and you can handmade cards, which is calculated in accordance with the method specified in the relevant guidelines approved by the industry contacts*. An annual percentage rate are a resource rate which includes the basic desire speed and other charges and you will charges regarding a loan device shown because the a keen annualised rates. Subscribed organizations are required to embrace an equivalent selection of legislation and you will assumptions to incorporate a normal basis out of computation, which will support borrowers examine mortgage circumstances supplied by some other banking institutions.

Fees terms and conditions

Absorb the fresh new fees regards to your loan. With a lot of funds, you may have an appartment time period to settle the bucks, generally speaking from 6 to 48 days. Should you choose an extended cost months, you’ll reduce the sized the payment, and enhance the total level of desire you have to shell out. Bear in mind that along the fees several months can impact the interest of one’s mortgage.

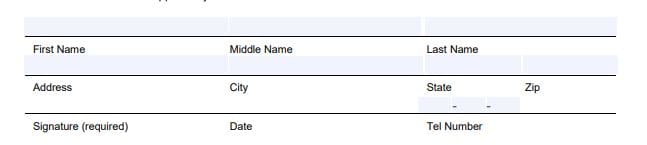

Documents getting loan application

Most banking companies or any other lenders usually ask observe next variety of data to help with your loan app. Particular lenders may require extra papers.

- Hong kong Permanent Citizen Label Credit

- Evidence of income, such as your newest payroll sneak, lender report otherwise passbook list the label, account and you can income

- Proof residential address, instance a utility expenses or lender declaration

Fees and you will fees

Loan providers are expected for legal reasons to post the costs, however should become aware of the fine print. Look for well-known charges and you will charges whenever borrowing:

- Handling percentage energized by the banking companies otherwise creditors getting control a good loan

- Very early payment charge: The lending company can charge an extra payment for folks who pay off that loan prior to when the brand new agreed term

- Later fees fees: In case the month-to-month fees are delinquent, you might be billed a lot more charges

- Cancellation commission: For those who alter your head and you can cancel financing once you have finalized the newest offer, the lending company may charge a termination percentage

- Costs for professional appraisers to determine the property value equity property

- Court charge repaid in order to attorneys to possess processing a home loan

Prize and incentives schemes

Of a lot finance companies provide their clients the chance to secure facts for the its charge card requests which is often redeemed to have gift suggestions, discounts or savings. not, these types of prize plans also commonly come with large rates and you can fees, so consider your finances and requirements cautiously. When you use their mastercard a great deal – and you will pay back the bill each month – a benefits plan can offer worthwhile professionals. But when you hold a considerable equilibrium in your card every times, a reward scheme’s highest attract costs could become a burden.

Supervisory tips

The brand new Hong-kong Economic Power (HKMA) accounts for the latest oversight out of financial institutions and exactly how it operate their personal bank loan businesses. The brand new HKMA’s Banking Perform Company inspections subscribed institutions to be certain they adhere to brand new Code of Financial Habit.

In terms of property financing, the HKMA purely enforce the borrowed funds To help you Value proportion (the mortgage number compared to the property value the property) and then have emphasises assessment of one’s borrower’s capability to repay because of the capping the newest borrower’s Loans Repair Proportion – brand new borrower’s monthly repayment financial obligation since a share regarding monthly income. It is possible to visit the HKMA webpages for more information.

No Comment