For those who have dollars, you need to use you to definitely

Scan The home

Unless you’re to get from the auction, you will find for you personally to always check the house. I usually highly recommend settling the best price you’ll be able to playing with an estimate regarding fixes that you find was conservative. If you’re able to rating a house lower than deal, you are able to do a very specialized examination and you may complete off your own design funds. A seven-go out inspection several months was practical, definition you’ll keeps 7 days to do your diligence in advance of your chance many serious currency. If you aren’t doing a whole remodel, I would suggest a professional evaluation. With a proper review report, you will understand exactly what solutions might be requisite. When you find yourself looking forward to one declaration, score a builder otherwise several onto the assets to produce offers. Having people estimates, there are much greater success with your funds.

Prepare yourself An aggressive Budget

- An evaluation of your complete value.

- The purchase price.

- Their framework quantity.

- Closing costs after you buy assuming your promote (if you intend to solve and you will flip)

- Carrying costs

Along with these types of number, you should be able to built a virtually guess of one’s earnings. In the event your enterprise doesn’t appear to have an old-fashioned finances, I recommend passageway towards bargain and having the earnest currency back. You’re going to have to disperse quickly to save you to definitely serious currency safe.

Redesign

In every foreclosure situation, attempt to upgrade the home. This may require as low as incorporating a separate coat off painting or creating new carpeting, otherwise this may you need a complete upgrade. New offered the latest home improvements just take, the fresh less might make, therefore flow timely right here. Attempt to get company in line with preparations during the put when you close towards the domestic. By doing this, they could start straight away. I also highly recommend visiting multiple homes currently in the market to get an idea of what kind of closes almost every other properties provides in identical urban area.

Setting Your own Standard

The new foreclosures organization is high quality. There is the potential for a ton of profit, and it is a lot of fun. I favor watching the fresh new sales from homes, and i also like selling house to delighted and you can grateful customers. However, competitive with this company is going to be, it doesn’t been simple.

This provider are going to be competitive, and it will surely require some work. You may want while making enough proposes to rating an individual family. You will also discover builders will likely be problematic to handle, and there was times when the house demands a lot more functions than just you questioned. You are risking each other your time and effort as well as your currency when you put money into property foreclosure.

no checking account payday loans in Ragland

Money Choice for Customers

The method that you want to loans your own commands is vital. It generates or break a great deal. Rather than a plan regarding how might buy the property foreclosure, it’s impossible on precisely how to be successful. Here are some of the ways you could potentially finance the foreclosures purchases worth considering.

Using dollars expands your wages since you won’t have an installment off financial support, but your output could be dramatically reduced, and you may expose you to ultimately significantly more exposure. When you reduce money you place into a deal, you restrict your economic risk.

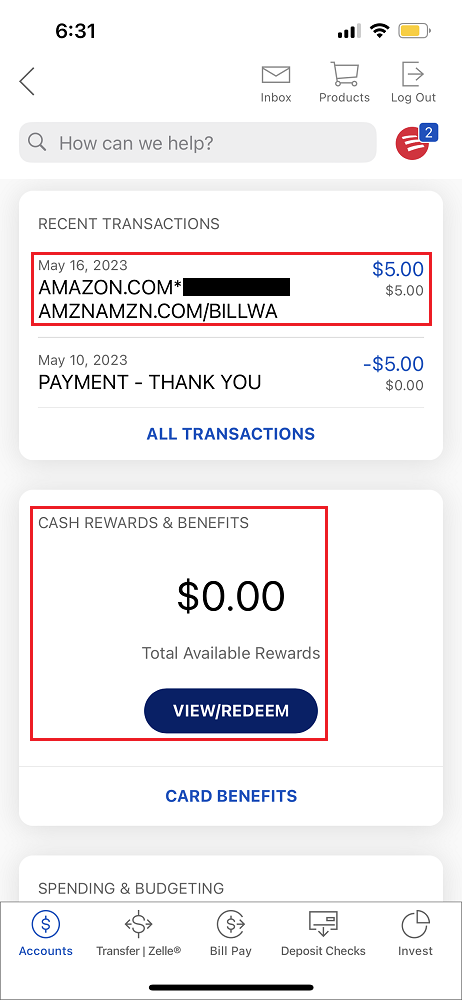

Personal lines of credit

A credit line is almost competitive with dollars. For individuals who very own other property, you’re in a position to open a personal line of credit you to you can access. A personal line of credit that is protected of the a house is called a beneficial HELOC (family equity line of credit). With good HELOC, you have to pay notice with the currency if and if you put it to use. These are also going account, you will pay it off then put it to use once again. Accessing resource is a huge virtue in this providers, so a good HELOC is an excellent unit the real deal home investors.

No Comment