Utilizing a home Guarantee Mortgage getting Debt consolidation reduction

express so it:

A home security loan will likely be a viable solution to own residents so you’re able to combine numerous debts towards an individual, lower-attract monthly payment. By tapping into your residence guarantee-the essential difference between your own residence’s really worth along with your outstanding financial balance-you might pay back debt and you may obtain economic independence. This article will walk you through the entire process of deciding if a home equity financing ‘s the proper financial choice for the situation from the determining appropriate debts for integration and detailing the application form procedure.

Why Use a property Equity Loan To repay Debt

A property collateral mortgage are a monetary equipment that offers home owners an adaptable solution to target individuals monetary means, along with debt consolidation. This method are going to be such as for instance helpful if you’re incapable of carry out several debts which have varying interest levels.

All the way down rates of interest. High-notice costs can simply bring about economic strain. By the merging these types of costs with the a house guarantee mortgage that have a all the way down Apr (APR), you can save money on interest costs and you may achieve greater monetary stability.

Sleek costs. Balancing multiple money shall be problematic. Merging your debts on the one, predictable domestic collateral financing payment streamlines your financial obligations and you may decreases the risk of missed payments.

Fixed rate of interest safeguards. Rather than changeable-price expense, a house security financing generally is sold with a fixed interest. It means your monthly payment stays consistent, shielding you from possible interest hikes.

Costs Most appropriate to possess Consolidation

Home guarantee financing are beneficial getting merging specific type of loans. Because of the insights which expenses may benefit from this method, you could potentially know if property collateral financing aligns along with your economic goals.

High-focus playing cards. Credit cards that have significant rates of interest are prime objectives to own combination. Of the replacement numerous mastercard balance having one family equity mortgage which have straight down costs, it can save you somewhat towards attention costs.

Unsecured unsecured loans. For those who have numerous unsecured personal loans with high rates, a property equity loan can offer a lesser-cost solution. Consolidating this type of finance towards the you to definitely fixed-rates payment is also describe your financial government.

Medical debt. Unforeseen medical costs might be economically disastrous. A property guarantee loan also provide the desired funds to pay for such expenditures, offering rest from high-attention medical debt.

Constantly consider your long-title economic plan when deciding to explore a house security financing. Whilst it will likely be a good economic approach, you should stop overextending your self financially.

Avoid using a home Collateral Mortgage for those Bills

Domestic collateral loans can be useful to possess consolidation, however, they aren’t usually the best choice for each and every personal debt. Wisdom when to end a property guarantee mortgage is a must to own and make informed https://paydayloancolorado.net/vilas/ choices.

Car and truck loans. Considering the quick depreciation off auto, playing with a house security financing to settle a car loan will likely be risky. In case your automobile’s worthy of minimizes reduced than the financing balance, you could end up due over the car deserves.

Holidays. Borrowing from the bank facing your home’s collateral to invest in holidays, welfare, or other low-extremely important expenses may be not recommended. This process develops debt exposure that will jeopardize your own homeownership for many who come across financial hardships. Envision an enthusiastic HFCU Special-purpose Checking account given that a less hazardous way to save to own discretionary investing.

Short-Identity Loans. Domestic guarantee funds can handle prolonged-term debt consolidating. On a single to pay off small-title debts, like playing cards otherwise funds which have reduced balances you might quickly pay back, may not be more effective method.

High-Exposure Expenditures. Borrowing from the bank facing your home’s guarantee to cover risky expenditures can be perhaps not a good idea. The chance of resource loss you will definitely jeopardize their homeownership.

Note: When you yourself have limited guarantee of your home, property equity financing might not be possible. Consider other debt consolidation reduction possibilities, instance balance import credit cards otherwise unsecured loans.

Understanding the House Collateral Financing Process

Bringing the methods so you’re able to combine the debt that have a home guarantee loan concerns a straightforward process. Here’s a broad analysis:

step one | Assess Your residence Equity. So you’re able to estimate your offered equity, dictate your own residence’s current market value and you can subtract their an excellent home loan equilibrium. Very lenders allows you to borrow a portion of equity, usually ranging from 80% and ninety%.

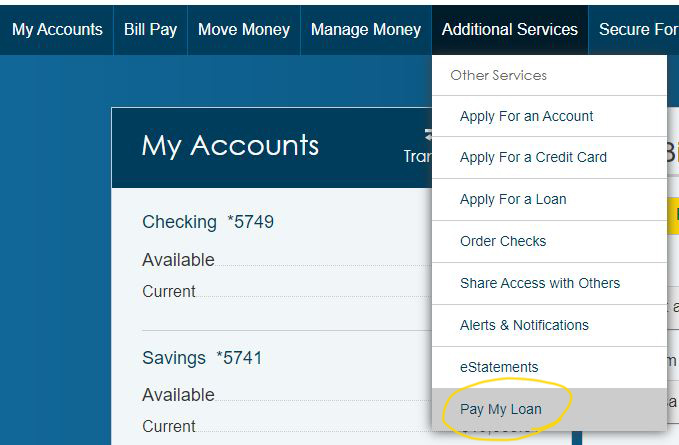

dos | Finish the Loan application. Give personal data, possessions details, money confirmation, or any other required files toward financial. Make certain your bank knows the borrowed funds is actually for debt consolidating. They will certainly want to know you will be settling other loans when while making their credit choice.

3 | Loan Acceptance and you will Disbursement. Immediately following recognized, you’ll get the borrowed funds money since the a lump sum payment. Specific loan providers need you receive the cash as the checks authored to the debtors you might be paying.

4 | Debt consolidation reduction. Use the loan continues to repay existing highest-desire expenses, instance playing cards, personal loans, or medical bills.

5 | Control your The Financing. Build uniform monthly premiums on the home equity mortgage to maintain good credit and prevent potential charges. For folks who paid back personal credit card debt, dont begin using the new notes once again. Recall you simply got out of credit debt; you don’t want to place oneself back involved with it.

Through this type of measures and you can cautiously offered your debts, you could potentially effortlessly have fun with a home collateral mortgage to consolidate and you may improve your debt management.

Happy to discuss your home guarantee options to pay-off financial obligation and take control over your money? Contact our financial advantages now to learn more about family equity funds and exactly how they could benefit you.

No Comment