Multifamily funds will likely be provided from the multiple lenders?as well as conventional banking institutions, credit unions, on the web loan providers, and you may loan brokers

Because there are all sorts of multifamily investment, credit score conditions are very different

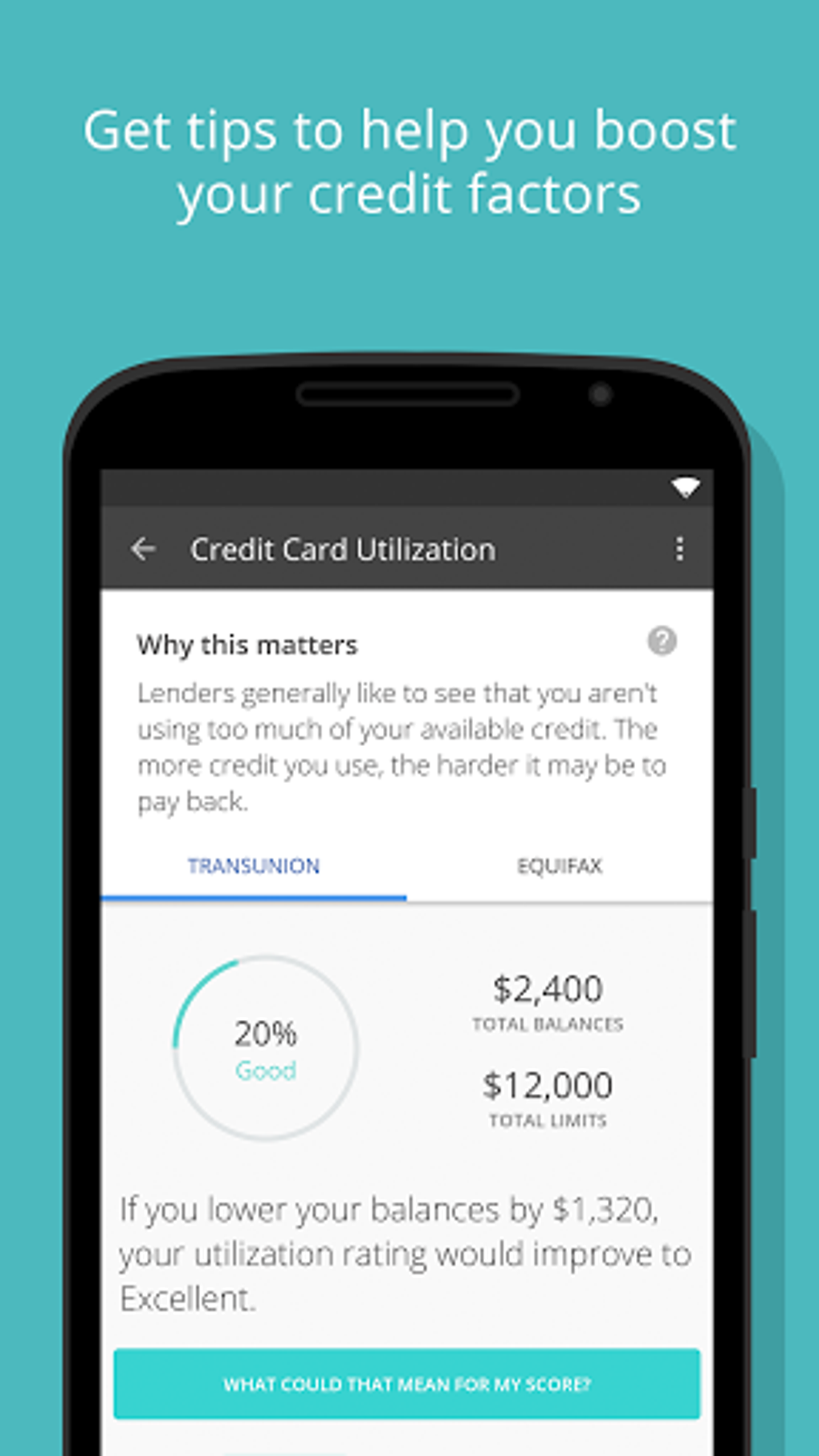

- Credit score: Lenders gets varying credit history conditions according to the loan kind of needed. That being said, certain encourage score only 500, while others can get consult a score regarding 680 or even more. The better your get, the better the possibilities of acceptance. Whether your get is gloomier, you can also discover lenders that especially thing fund to possess poor credit.

- Amount of time in business: Certain fund possess amount of time in team requirements to exhibit your own investment sense. This might be well-known to have improve-and-flip financial investments, while the lender desires decrease the risk of default with the the mortgage that can perhaps not give so you’re able to inexperienced traders.

- DSCR: DSCR are determined since your internet operating income split up by your current year’s personal debt. Its one method to size your own organization’s ability to spend its debts predicated on your money flow.

- Downpayment: Advance payment conditions ranges of 0% up to twenty-five% or more. While not very important to most of the multifamily finance, you’ll usually find a very good costs and you may financing terms out-of organization that want a much bigger advance payment.

Since there are all types of multifamily funding, credit score conditions will vary

- Banks: Banks usually have a wide range of financing systems. not, qualification criteria become strict with little liberty to have coverage exclusions. In addition to lending products, you can observe all of our set of the best finance companies the real deal estate traders for further qualities including debts administration possibilities and you can rent range.

- Credit unions: Credit unions are not-for-finances organizations to provide much more competitive prices than financial institutions. According to credit relationship, you can also attract more self-reliance regarding eligibility standards. That disadvantage, whether or not, would be the fact these types of financial may not have as numerous facts because that a bank. The roundup of your better borrowing unions for small businesses may feel a great place to begin.

- On line loan providers: These merchant can offer a few of the most aggressive costs. This will be partly whilst enjoys a lot fewer expenses for things like rent money to own physical part places. In exchange for straight down cost, you need to be safe conducting business generally on the web. Listed below are some the directory of a knowledgeable commercial a home money for most choices.

- Mortgage brokers: Brokers enjoys a system from credit couples and certainly will use its assistance to complement you on the loan most appropriate to suit your means. Any of the business inside our guide to a respected business loan brokers will save you big date from implementing on their own so you can multiple lenders.

Once you’ve located an applicable bank, establish the eligibility and you can fill in a proper application for the loan. You’ll need to complement the applying with different documentation, because expected of the financial.

The particular directory of called for data vary in accordance with the financing, the lender you select, plus certain circumstancesmonly expected points tend to be taxation statements, bank statements, or any other economic statements-such an equilibrium piece and you may finances & loss declaration.

Upon review of your application, the lending company commonly prove your own qualification. In the event the accepted, personal installment loans for Nevada it can give you mortgage info including rates and you may terms and conditions.

Faqs (FAQs)

Loan providers will have other choosing affairs whenever giving a financing choice; but not, you really need to try using a rating with a minimum of 600 to help you be considered eligible for very kinds of funding.

It all depends to the brand of mortgage you have made. Usually, there are manager-occupancy standards important for bodies-recognized funds. As the a condition of your own financing, you should alive and you may conduct business at property becoming entitled to financing options.

No Comment