Choosing just the right mortgage when you look at the Washington Condition (2024)

Whenever money a house, financial interest levels notably change the total cost of buying a beneficial home ultimately. A-1% difference in financial rate of interest results in thousands of dollars throughout 15 to help you 3 decades. Your interest rate are affected by of numerous products along with credit rating, advance payment, and you may loan variety of. Whenever financial support your property you can find other loan choices to fulfill your needs and you may desires.

Every type of home loan is perfect for a different type of debtor, so for each includes more benefits and drawbacks. Solarity offers several mortgage items and you will terms, and you may the audience is committed loan places Ohatchee to shopping for one which is very effective for you.

Fixed rates

A predetermined-speed financial enjoys an equivalent rate of interest with the life of the mortgage, rather than an adjustable-speed financial where interest rate can be change. The main benefit here is one since you remember that your price are locked, cost management for your casing fee is straightforward and you can foreseeable. You are protected against abrupt changes in interest rates, even when your own personal is not necessarily the reasonable you to definitely on the market.

While to shop for property that you’re pretty sure you can remain to have lengthy and you should have enough sleep later in the day knowing their month-to-month mortgage repayment would not change, a predetermined-price financial is a fantastic solution. This will be probably one of the most well-known types of residential home loan loans.

Adjustable rate

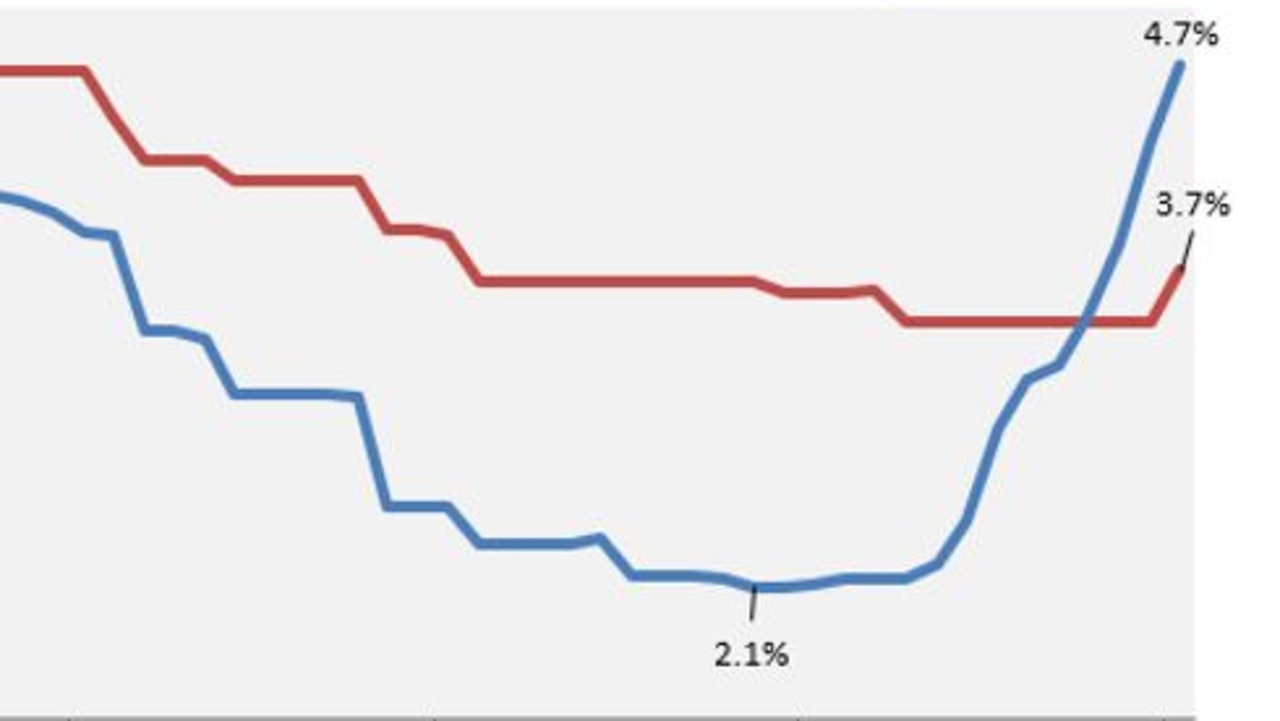

Adjustable-price mortgages, both described as Fingers, provides interest levels which can change to match the prevalent sector rates. You can wonder as to why people will love a changeable-price financial when fixed costs are available. Arms incorporate a special virtue – inside first couple of many years (usually three to seven), the speed try temporarily locked in within a lower rate than what you would discover towards the a consistent repaired-rates mortgage. Then, following this intro several months, the speed tend to to improve upwards or down each year to match the market.

Some home owners function better out-of towards the safeguards out-of a fixed-rate loan, adjustable-rate mortgage loans are a useful product to possess residents that are almost certainly to move or re-finance until the secure-into the several months is more than.

No down-payment

For almost all functioning household, brand new down-payment is a massive barrier so you’re able to homeownership. Nonetheless it doesn’t have to be like that. If you have a steady earnings and certainly will pay for a property commission (but they are a tiny quick toward cash), a no-down-payment home loan is a superb avenue to getting a resident.

No-down-payment funds need you to spend private financial insurance rates (PMI) with each commission, but this might be nevertheless will less expensive than renting. Plus, you’re going to be strengthening collateral since you pay your property.

All of us Company out-of Agriculture (USDA) funds are perfect for low to help you average-money consumers that are looking their own cut regarding heaven in the country, but they are ideal for those who are searching for homes when you look at the outlying locations (to thirty-five,000 anybody). The goal of such financing would be to enhance the savings and you can populace from agrarian and you can outlying parts.

USDA money are glamorous because they can money up to 100% of your own cost of the house, and additionally they need no down-payment. Yet not, your earnings can’t be above a specific threshold, and your upcoming family need certainly to see particular advice to help you qualify.

Connection money

Time the business of one’s established house with the acquisition of an alternative you can end up being exceedingly hard, specifically if you are preparing to make use of your home guarantee just like the an element of the advance payment. That’s where a connection financing is available in useful.

Link loans are created to security the brand new pit between your selling of one house and the acquisition of a special. They allow you to forward the newest guarantee out of your old household for the new one. Having a bridge loan, you might fund around 90% of your appraised worth of your house, while build attract-simply costs for up to two years. To make things also convenient, you could close their link loan meanwhile while the your brand new pick.

Refinance

Refinancing makes you reconfigure the loan in order to all the way down your own commission, score a smaller identity, or cash-out several of the residence’s guarantee. If you would like finance particular significant home repairs or pay from highest-appeal expenses, an earnings-away re-finance makes it possible to achieve your requires.

Along with, in the event that latest interest rates was less than the one you really have on your own new financial, refinancing so you’re able to a lowered speed tend to potentially save you tens and thousands of cash inside desire over the longevity of the loan. You’ll be able to play with an effective re-finance to improve a changeable-rate mortgage toward a fixed-rates financial. Simply speaking, if for example the brand-new financial isn’t really top, you might refinance it to your a loan which is.

HELOC

A home guarantee credit line (HELOC) enables you to utilize their house’s guarantee in the place of switching the amazing financial. For those who have a minimal-rate of interest or is next to settling your home, an effective HELOC could make alot more feel than refinancing.

With an effective HELOC, you might borrow on your home since you need the bucks. In manners, a beneficial HELOC feels like credit cards that is covered by your house. When you look at the draw months, you can withdraw from your house’s security and you may only pay towards the the attention. Since you pay back your HELOC, your free up borrowing from the bank in order to borrow once more down the road, similar to credit cards.

Lenders having a boost

Establishing Solarity Credit Relationship and best mortgage sense you can easily ever before keeps. We result in the mortgage procedure without headaches. You could implement online in only a matter of minutes.

Rated 93 off 100 by the tens of thousands of Solarity individuals, all of our on line home loan techniques saves your valuable time to attract with the items that matter. And the expert Financial Guides is right here to simply help all the step of the ways.

All of our pro Financial Books try here to greatly help

There’s nothing the house Mortgage Courses like more than viewing professionals transfer to their dream property. Our company is right here to keep anything as simple as possible (as well as a fully on line yet , custom processes)!

No Comment