An excellent HELOC will give you the option to get dollars within when plus whichever increments you adore

What’s a beneficial HELOC?

Property collateral personal line of credit – otherwise HELOC – try a great revolving line of credit that transforms your property equity on the financing you could spend on almost anything. While other types of domestic security fund provide a lump sum payment, a good HELOC offers a credit line to pull money as needed.

Access an open credit line is better in order to lump sum payment fund in a number of issues – as an example, if you want to renovate your house however, are not sure just how comprehensive the work might possibly be otherwise just how much it’ll cost you once accomplished. Taking right out a timeless mortgage to cover all your repair expenditures could be most difficult where problem as you never understand how far currency you’ll want to perform the job. The maximum amount nowadays having detachment was physically determined by the amount of guarantee you have of your home.

If you decide to apply for a good HELOC loan, keep in mind that you are making use of your domestic because the equity and you will opening an extra mortgage on your property. That implies you will have to generate several mortgage repayments monthly – one for the original financial plus one for the HELOC mortgage. Together with, you to second mortgage gets rates of interest which might be likely varying which get vary significantly along side longevity of the loan, based on multiple market-built facts.

The amount of money can i acquire with good HELOC?

The loan amount is largely according to your property security. In many cases, Guaranteed Rate get approve good HELOC that have a mixed financing-to-value (CLTV) ratio as much as 85%.

Which have a guaranteed Price HELOC, you could remove a line of credit having as much just like the $eight hundred,000, dependent on the qualification qualifications.*

*The financing quantity range from at least $twenty five,000 so you can a total of $eight hundred,000. To possess attributes located in AK, the minimum amount borrowed is actually $25,001. Their limitation loan amount are lower than $eight hundred,000 and will fundamentally confidence your property really worth and you can guarantee during software. I dictate house value and you can ensuing guarantee thanks to independent analysis source and you can automatic valuation models.

How to qualify for a good HELOC loan?

- Credit history: 620 minimum

- Debt-to-earnings proportion: 50% restriction

- Joint loan-to-well worth ratio: 85% maximum

- Possessions products: single-family members households, townhomes and you may apartments are qualified

Exactly what do I personally use my HELOC funds on?

Once your credit line are unlock, you may be able to invest those funds in lots of ways. Some of the most well-known uses for a great HELOC tend to be:

- Consolidating highest-attention financial obligation such handmade cards

- Level significant expenditures such as for example house renovations

- Investing in repeating will cost you such as expenses

How to get a HELOC mortgage?

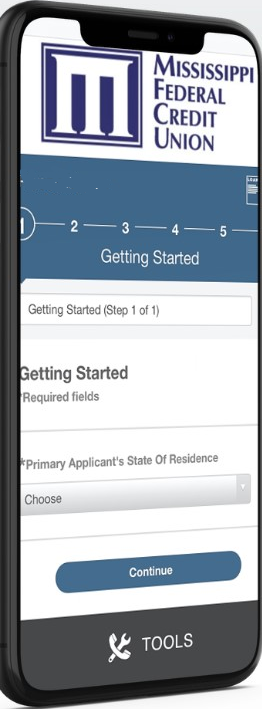

Applying for a beneficial HELOC with Secured Rate is quick and easy. The 100% electronic app process is going to be completed within this 10 minutes. In the event the acknowledged, you will receive your own financing as soon as four months out of mortgage approval.

step 1 Guaranteed Rates, Inc. house collateral personal line of credit (HELOC) is an open-prevent unit in which the complete amount borrowed (without any origination fee) could well be 100% removed during origination. The initial count financed at origination depends on good repaired rate; however, the product includes an extra mark ability. As the debtor repays the bill at stake, the fresh new debtor could make additional pulls for the draw period. If the debtor elects and make an extra mark, the rate regarding mark might possibly be place at the time of this new go out of draw and will also be considering a keen Directory, the Prime Rate blogged regarding Wall Street Diary into calendar month preceding brand new date of your additional draw, including a predetermined margin. Appropriately, this new repaired rate your a lot more draw can be more than this new repaired rates towards the very first draw. The item is currently perhaps not available in the states of brand new York, Kentucky, Tennessee, Colorado, Western Virginia, Delaware and you will Maryland. The fresh new HELOC needs one guarantee your property since the security, and you you can expect to get rid of your property if you’re unable to pay back. Consumers need satisfy minimal financial conditions to be eligible to have financing. Designed for primary, next homes and you may resource characteristics simply. Influenced by minimal credit score and you will debt-to-money standards. Occupancy standing, lien position and credit history are typical points to determine the price and you can max offered loan amount. Not all individuals could be acknowledged. Candidates subject to credit and underwriting recognition. Get in touch with Protected Rate to find out more also to explore your own personal situations. Restrictions Implement.

No Comment