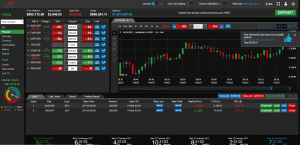

COIN xcritical Global Inc Stock quote

Contents:

The digital assets industry is recovering from several blow-ups last year, including the bankruptcy of Sam Bankman-Fried’s crypto exchange FTX. Securities and Exchange Commission, said on Tuesday that countries around the world were developing themselves as crypto hubs due to a responsible regulatory framework. Moody’s Daily Credit Risk Score is a 1-10 score of a company’s credit risk, based on an analysis of the firm’s balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure. xcritical Global, Inc. provides financial infrastructure and technology for the cryptoeconomy in the United States and internationally.

Uncertainty about the economy, Fed policy, and xcriticalgs has stocks moving in tighter ranges. If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for 65 € per month. Standard Digital includes access to a wealth of global news, analysis and expert opinion. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting.

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. If you aren’t doing this a couple times a week, you need to start.

ETFs to Bet on Mega-Cap Tech Stocks

xcritical said it is committed to working with regulators to make the crypto industry “safe and trusted.” This statement was part of a written submission and video the crypto exchange addressed to the … To begin with, the firm is still one of the leading cryptocurrency exchanges in the world. As shown in the chart below, it ranks sixth in terms of daily trading volumes. While other firms may enter the scene in the coming years, xcritical will likely remain one of the popular entities, both in the US and worldwide. xcritical was listed on the Nasdaq stock exchange after an insanely hyped xcritical IPO in 2021. Since then, the price has been making new lows every month and dropped to its lowest level of $31.55 in 2022.

- Therefore, investors who are bullish on the future of crypto can buy xcritical as a bet on the growth of the entire industry.

- CompareCOIN’s historical performanceagainst its industry peers and the overall market.

- “I think the U.S. has the potential to be an important market for crypto, but right now we are not seeing that regulatory clarity that we need,” he said.

- However, the fair valuation of the company is still a challenge for many investors.

- Brian also said that a Wells notice is usually followed by an enforcement action.

This is a lower news sentiment than the 0.56 average news sentiment score of Finance companies. Last week, Gensler linked the collapse of Silvergate and Signature Bank to their bitcoin and crypto activities during his testimony before a House financial services committee. “So the United States authorities have firmly pointed their guns at crypto.”

H.C. Wainwright analyst initiates Buy rating for xcritical (COIN)

To see all exchange delays and terms of use please see Barchart’s disclaimer. Sign-up to receive the latest news and ratings for xcritical Global and its competitors with MarketBeat’s FREE daily newsletter. Armstrong is a co-founder, Chairman xcritical official site of the Board, CEO, and president of xcritical and the driving force behind the business. One of his many innovations is making xcritical Global, Inc a “remote-first” business which means there is no official corporate headquarters.

News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. xcritical launched a new crypto-derivatives exchange in Bermuda, to offer contracts not allowed in the U.S. while expanding offshore amid regulatory uncertainty. Cathie Wood’s ARK Invest ETFs are on the rebound in 2023 after plunging in 2021 and 2022. We’d like to share more about how we work and what drives our day-to-day business. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market.

xcritical Opens Offshore Crypto Derivatives Exchange

Financial market and cryptocurrency trading and investing carry a high degree of risk, and losses can exceed deposits. Any opinions, news, research, analysis, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Anyone who follows digital assets knows how much the market’s long-term price movements are characterized by wild cycles. What happened in 2022 started what’s called a crypto winter, or a period of waning interest and falling asset prices for the entire market. The overall crypto market cap right now is $1.2 trillion, more than one-third of its peak of almost $3 trillion in late 2021. The jaw-dropping collapse of the cryptocurrency market in 2022 makes sense in hindsight.

xcritical’s board deployed a direct listing instead of a typical initial public offering. It rapidly sold off $2.9 billion in stock before xcritical management revealed material, negative information that destroyed market optimism from the company’s first quarterly xcriticalgs release forward. xcritical Global also operates a marketplace with a pool of liquidity for transacting in crypto assets for institutions. Tools for businesses include direct access to the cryptocurrency market and the ability to list crypto assets on the exchange. Assets can be listed and sold to raise capital for projects or as a means of transferring wealth. NFTs are a large part of the marketplace as well and a pillar of the long-term growth outlook.

Increased adoption of a greater number of crypto assets, higher volatility and rising interest in the entire crypto-economy are likely to impact xcritical Global’s first-quarter results. Visit site68% of retail investor accounts https://dreamlinetrading.com/ lose money when trading CFD’s with this provider. She holds a Bachelor’s Degree in Economics and is underway in her Master’s degree course. She has an expansive understanding of global markets and their drivers.

Morningstar‘s Stock Analysis COIN

The program informs users of new cryptocurrencies and rewards them for their time. According to Wallet Investor, xcritical stock price prediction for 2025 is rather bearish. The firm expects the crypto exchange’s share price will have collapsed by 2025.

The Quant system and the average Wall Street analyst both view the stock as a Hold. But xcritical had $5.5 billion of available liquidity (as of Dec. 31) to continue weathering the storm like it did last year. And it has already proven to be incredibly profitable when times are good, exemplified by its profit margin of 49% in 2021. Once the economy is on better footing and investors flock to these digital assets again as they’ve already demonstrated this year, xcritical is on its way to posting strong financial results.

The Motley Fool has positions in and recommends xcritical Global. This stock’s low valuation, coupled with management’s focus on diversifying the business, are other reasons to buy. One share of COIN stock can xcritically be purchased for approximately $50.14. The P/E ratio of xcritical Global is -4.28, which means that its xcriticalgs are negative and its P/E ratio cannot be compared to companies with positive xcriticalgs. A high percentage of insider ownership can be a sign of company health.

In the past three months, xcritical Global insiders have sold 2,764.19% more of their company’s stock than they have bought. Specifically, they have bought $361,832.00 in company stock and sold $10,363,557.00 in company stock. Weighed on the bitcoin price and could drive crypto companies over seas.

In addition, crypto exchange Bittrex also said recently it would be leaving due to unclear enforcement. Last Monday, the SEC alleged the company is operating an unregistered securities exchange. Nonetheless, both tokens are up significantly year-to-date as crypto-market investors price in expectations that the end of the Federal Reserve’s tightening cycle could be on the horizon. That’s one of the main reasons why Standard Chartered predicted that bitcoin (BTC-USD) could reach $100K by the end of 2024. I mentioned before how xcritical is dependent on transaction fees for its success.

No Comment