Virtual assistant Financing Eligibility Letter Virtual assistant Home loan Certificate off Eligibility

Virtual assistant loan Certification out of Qualifications exists from the army affiliate. There are many a means to receive good COE; you can do it yourself or having a lender.

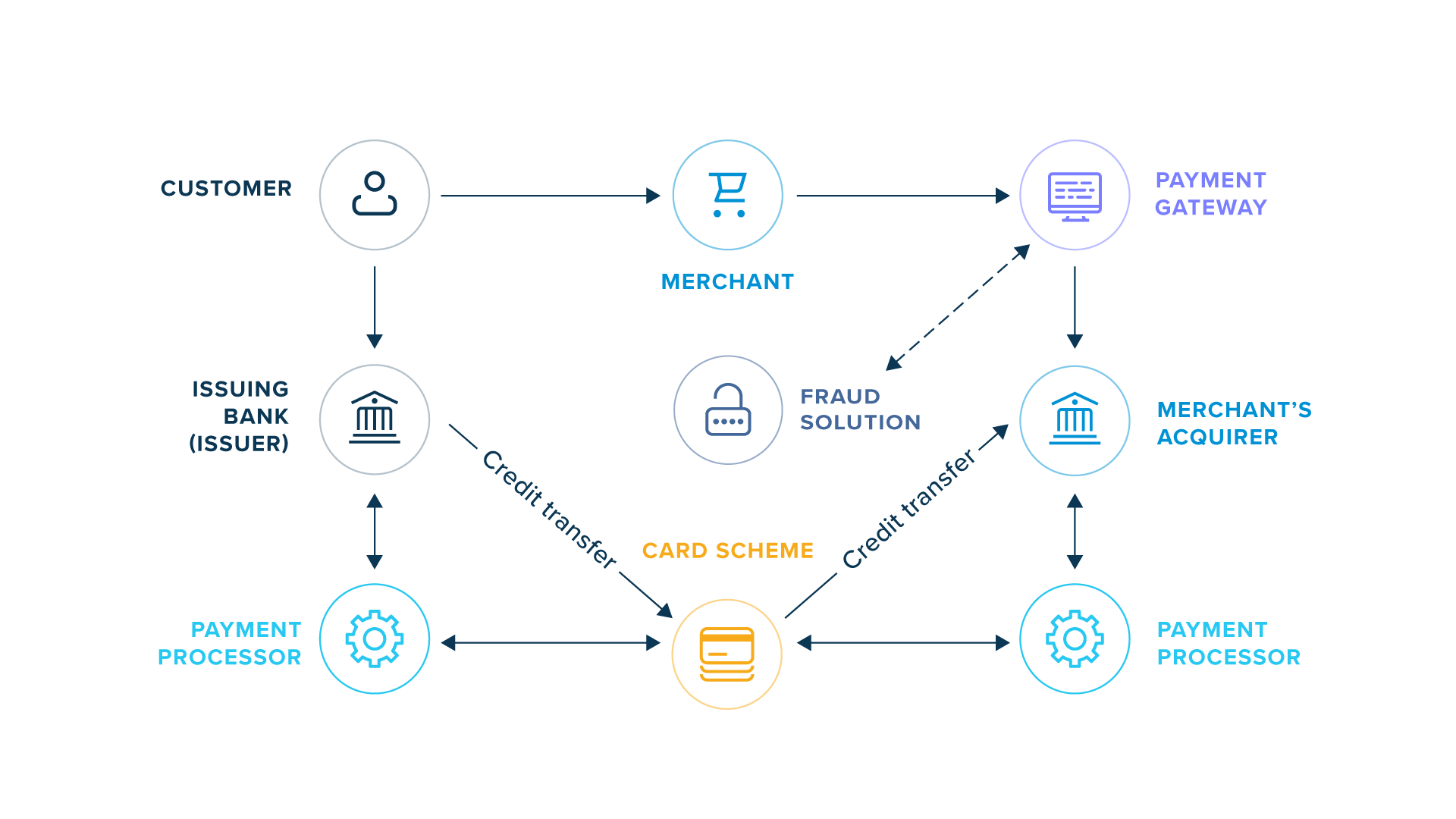

When obtaining a great Virtual assistant loan Certificate of Qualifications (COE), you should invariably understand that the brand new Company out-of Pros Circumstances isnt investment the fresh new buy or even the re-finance. Money is the financial, who is responsible for offering the money toward loan. Precisely what does which means that for you? That means that this new Virtual assistant is who gives you the original step up the process to find the Va mortgage positives, which is the COE. So it letter lets a lender to know that you are licensed to start the program and make use of an excellent Virtual assistant mortgage. The lender is the step two following Virtual assistant says your are able to use the newest Va loan benefits.

The lending company will get your complete a credit card applicatoin and remark the credit history and you may financial situation to let you know, while the debtor, what you can be eligible for. An individual will be eligible to a certain amount, you’ll know your budget to possess property otherwise what transform you ought to make so you’re able to meet the requirements. Consider, lender qualifications regarding loan providers are common more and change have a tendency to, so be challenging and you may search most of the solutions.

What’s a certificate out-of Qualifications (COE)?

A certificate of qualification is actually a file you to a veteran tend to need to comprehend the pros offered to get good Virtual assistant financing. Its a simple file that will county exactly what, while the a veteran, you are desired to suit your Virtual assistant financing. Its a little while difficult to learn and just have a grip out-of but why don’t we undergo particular facts. This can help you finest comprehend the file and you will everything you must do to make the most of your qualification.

Getting Your own Va-recognized financial Eligibility page given that a seasoned

You will find one or two ways to get ahold of one’s Certificate off Eligibility which ultimately shows you what you’re entitled to given that a seasoned, effective responsibility user, or accredited family member.

- Visit the Agencies from Pros Affairs Va webpages and you can realize the newest rules to get it in the E-benefits webpage to utilize online to get a copy.

- Use an effective Va-certified bank who’ll consult new Certification regarding Qualifications on the account

- Demand from the post. Make use of the Virtual assistant web site to to obtain your working environment, or telephone call step 1-877-827-3702 locate a speech so you can demand of.

Ways to get Your property Financing Certificate of Eligibility while the an enthusiastic Energetic Armed forces Representative

The best way for an energetic Responsibility Military affiliate so you’re able to access the COE will be to log in to the new Elizabeth-gurus website and install the fresh document. That have a familiar Accessibility Card (CAC), it can be two moments before you could are all joined. Once you are on the website for Age-pros, select the site having records to see a good stop demand my personal COE. It can provide the substitute for click and you can discover the brand new file once the a PDF. Simple posts when you can make sure which have a beneficial CAC.

How to get Their COE just like the a member of the latest Supplies otherwise Federal Protect

Reserves/ National Shield, immediately after half dozen numerous years of solution otherwise having an assistance-linked Va handicap, can also rating qualified in some cases. Anticipate to share their part layer together with your lender. According to their standing and you can entry to other options, in addition there are your own Certificate of Eligibility of Age-advantages, because in the above list.

Okay, pay attention; this is exactly fun articles. If you had a good 90-go out service with thirty day period out of straight provider which have title thirty-two USC section 316, 502, 503, 504, otherwise 505, you could be eligible for an effective Virtual assistant mortgage! For the resource, it was introduced at the beginning of 2021 inside personal loans bad credit Arizona the an excellent Va Circular (26-21-08). This might be a casino game-changer for almost all of one’s veterans. Pose a question to your lender and you may keep trying rules and you will lenders who happen to be awesome cutting-edge on the advice to your Va mortgage qualification. Due to the fact a house customer, you are going to constantly do search to help keep your domestic upwards, of course, if you then become an investor, you’ll put in so much more try to ensure that your financing is actually out of the way and others was spending you. Have you thought to start the journey from planning by the looking at all of the of advantages starting now prior to buying?

No Comment