Income tax Place of work Funds 7 to truly get you Become and much more!

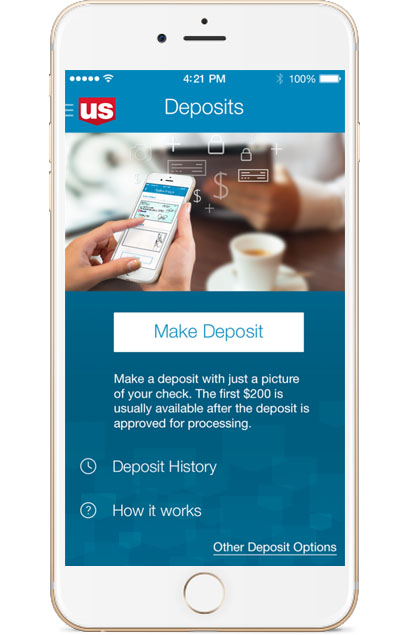

Direct Put

We all know exactly how much gets into having your workplace in a position getting tax seasons. That is why you can expect cash flow help qualified taxation preparers to obtain come. You can expect pre-season workplace initiate-upwards money, in-seasons commission enhances, application pick guidance, and a respect program so you can award your visitors.

Along with 38,000 taxation practices subscribed to our system, the audience is the low-rates business commander with in so you can desire clients and take your company to a higher level. We leave you accessibility apps is competitive on your own industry, provider choices customized getting tax organizations, and award-winning customer service.

EPS President, Clark Gill

step one. The new Refund Transfer try a recommended tax refund-related tool given by Pathward , N.A good., Affiliate FDIC. The new Refund Import isnt financing. E-processing from income tax go back is required to qualify for the product. Susceptible to approval. Charges incorporate. See terms and conditions to possess information.

2. Particular Refund Improve Fund arrive free-of-charge to help you taxation preparers and you will taxpayers, not additional options tend to be an advertising percentage and you may individual fee.

step 3. The newest Reimburse Progress is an elective income tax-reimburse relevant financing provided with Pathward, Letter.A great., Affiliate FDIC (that isn’t the real taxation reimburse) on playing towns. Program access and you will financing amounts ount of the financing and you may relevant interest would-be subtracted out of taxation refunds and relieve the total amount which is paid back right to the latest taxpayer. Costs to many other recommended circumstances otherwise device features will get implement. Taxation statements are registered digitally instead of trying to get this mortgage. Loans offered in quantities of $250 (in which available), $five hundred, $1,000, 25%, 50%, otherwise 75% of your own asked tax refund doing $7,000, which have attract-established people getting normally $dos,; $eight,000 offered just to really-certified applicants which have the absolute minimum asked income tax refund from $9,569. Underwriting conditions subject to change. Whenever figuring the level of your loan, the level of your expected tax refund are affected by one refundable taxation loans and you will charges. Financing regarding the quantities of $250, $five hundred, and $1,000 provides an annual percentage rate (ounts from 25%, 50% online installment loans Michigan bad credit or 75% of your own questioned income tax refund enjoys an enthusiastic ple, $dos,500 financing representing 50% from asked reimburse lent more 31-date identity, complete matter payable in one fee are $2, along with attract. Availability is actually susceptible to fulfillment out of identity confirmation, qualification standards, and you will underwriting standards.

5. A marketing payment out-of $ applies for every single accepted During the-Year progress with e-Collect and you will e-Incentive applications otherwise fund rather than a refund import. $ or utilization of the FasterMoney Visa Prepaid card to have disbursement which have age-Assemble and you will e-Extra.

six.$ or utilization of the FasterMoney Charge Prepaid card to possess disbursement. Even more selling fee is applicable per accepted advance which have e-Gather and you may e-Bonus applications otherwise finance rather than a refund import. Availableness and charges may vary by application.

8. The fresh new FasterMoney Visa Prepaid card is actually issued because of the Pathward, N.A., Associate FDIC, pursuant to help you a licenses out-of Charge You.S.An excellent. Inc

9. e-Bonus Terminology: EPS pays a good $8 rebate for each funded view and you will lead put disbursement and you may $16 per card disbursement. An additional rebate out-of $cuatro could well be awarded each additional funded deposit into people disbursement. Financial support is described as one taxpayer return funded of the Internal revenue service otherwise suggest that discusses the complete e-Incentive unit cost of $ (account build payment) otherwise next $fourteen (a lot more deposit fee) and you can try funded within beginning of the eFile and you will . The fresh promotion could well be sent to the taxation elite group via ACH ranging from . EPS supplies the right to keep back one promotion resource if for example the income tax elite owes EPS money from copy inspections, too-much mortgage losings, scam, enrollment condition, and other issues. Discount access varies by condition and you can software.

No Comment