Casing cost is really stressed you to Lennar can offer a predetermined cuatro.75% financial rate inside the Colorado

Lennar are rated Zero. 119 into the Luck five-hundred

As a result towards constant mortgage speed amaze, homebuilders all over the majority of the world keeps accompanied a strategic means in order to stimulate domestic conversion process through providing online productive rates incisions. This method stands installment loans Tennessee inside stark evaluate on established home market, where domestic vendors for the majority segments, especially in this new Midwest and Northeast, have been unwilling to straight down the costs.

Although some designers features turned so you can straightforward rates decreases (KB Home President Jeffrey Mezger said that is his liking) or cash incentives abreast of closing, the most popular strategy among many preferred developers is offering home loan rate buydowns outgoing (D.R. Horton President David Auld informed me which is his taste). This type of buydowns, differing during the stage, features presented their possibility to incentivize potential buyers. Particular offer short-term rate decrease to the initial decades, and others continue the bonus from the whole mortgage identity.

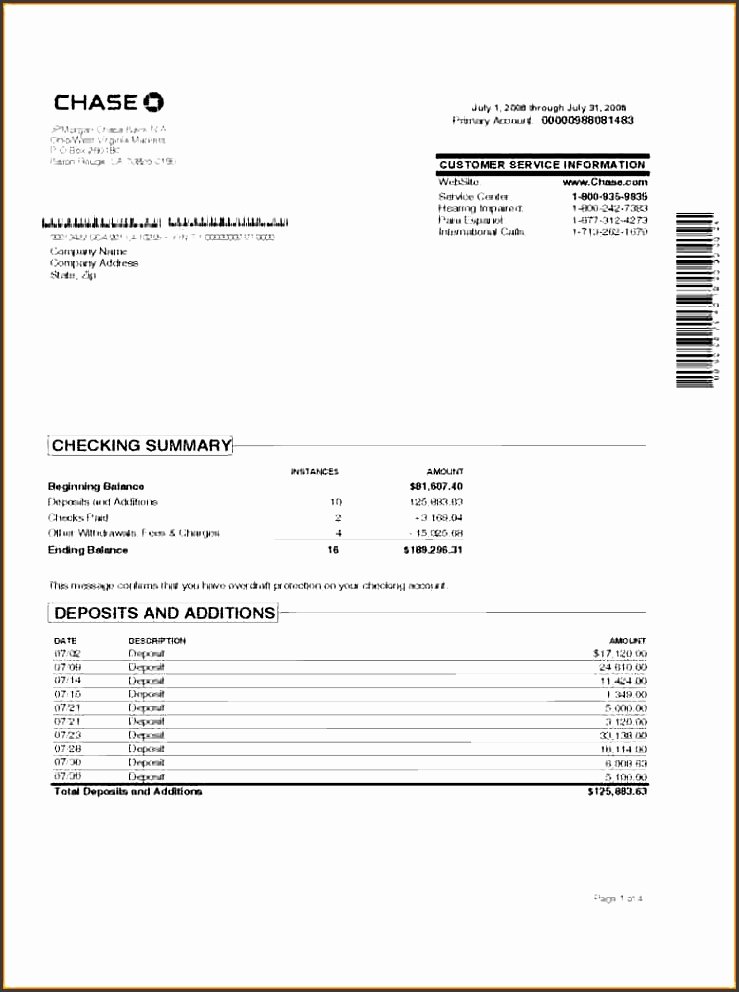

One celebrated analogy arises from Lennar, a great homebuilder currently ranked Zero. 119 for the Luck five hundred list. Lennar try actively generating a traditional mortgage having a fixed rates of cuatro.75%, or $33,500 to the settlement costs, inside select Colorado teams. So it offer out of Lennar is valid of these who signal a purchase arrangement for the a select disperse-within the ready family when you look at the Colorado between and you will .

What exactly is interesting? Into the Sep 19th, Lennar is actually advertisements good 4.25% buydown in Tx. Very over the past week, because financial rates has actually ticked nearer to 8%, Lennar have moved the buydown regarding 4.25% in order to 4.75% when you look at the Texas.

It isn’t just Lennar, read this tweet by the Rick Palacios Jr., movie director out-of look in the John Injury Search and Asking. It implies that PulteGroup, a homebuilder ranked No. 259 to the Fortune five-hundred, has also drawn back towards its buydown offers. Supposed out of 4.99% inside April, so you’re able to 5.75% as of October.

Showed up makes it simple buying shares of leasing homes, enabling people to secure passive money and you can make the most of worth of really love. Only select the wide variety of higher-quality leasing land and invest ranging from $100 and you can $20,000 for the for every assets.

Showed up manages new administration & procedures, to help you sit-down and construct money. Showed up try supported by world-class investors together with Jeff Bezos & Marc Benioff.

It seems that some designers is scaling back their buydowns because spiked mortgage pricing, that have risen from the average 29-seasons repaired financial price of 7.15% on the August 1st so you can 7.66% to date, have increased the cost of offering buydowns for the past one or two months.

It buydown pullback, therefore the proven fact that certain individuals are receiving quoted home loan rates having an 8 deal with, can cause brand new home transformation in order to again pull-back.

Into very early August an ohio homebuilder said one to Individuals are definitely always this type of [mortgage] rates today… people [homebuyers] try buying mud thought [mortgage] rates could be straight down by the time their home is accomplished. An entire 180 from a year ago.

not, while i achieved out to that same Columbus-established creator on the Saturday, he had an even more melancholy tone: “October could have been a good ghost area. Sep is actually very active but that is once we run our yearly venture. We had been expenses 3 facts on resource to own land that may personal this year many $ from the home”

The newest foundation enabling this type of prominent homebuilders, including Lennar and you may D.R. Horton, to make usage of for example aggressive buydowns is the ongoing good income. This type of profit margins continue steadily to surpass pre-pandemic profile, giving them the latest monetary self-reliance must engage in proper operate to increase transformation while making homeownership much more attainable throughout these turbulent moments.

Houses value is so troubled you to definitely Lennar can offer a fixed cuatro.75% financial rate inside the Texas

My standard attitude? If the mortgage prices always hover to 8%, there may likely be more downwards pressure on the creator margins, particularly if they think obligated to again build cost adjustments, such providing extra cash in the closure if not implementing outright price slices.

Many thanks for signing up for ResiClub! Nothing within email address is intended to act as economic guidance. Do your own search.

No Comment