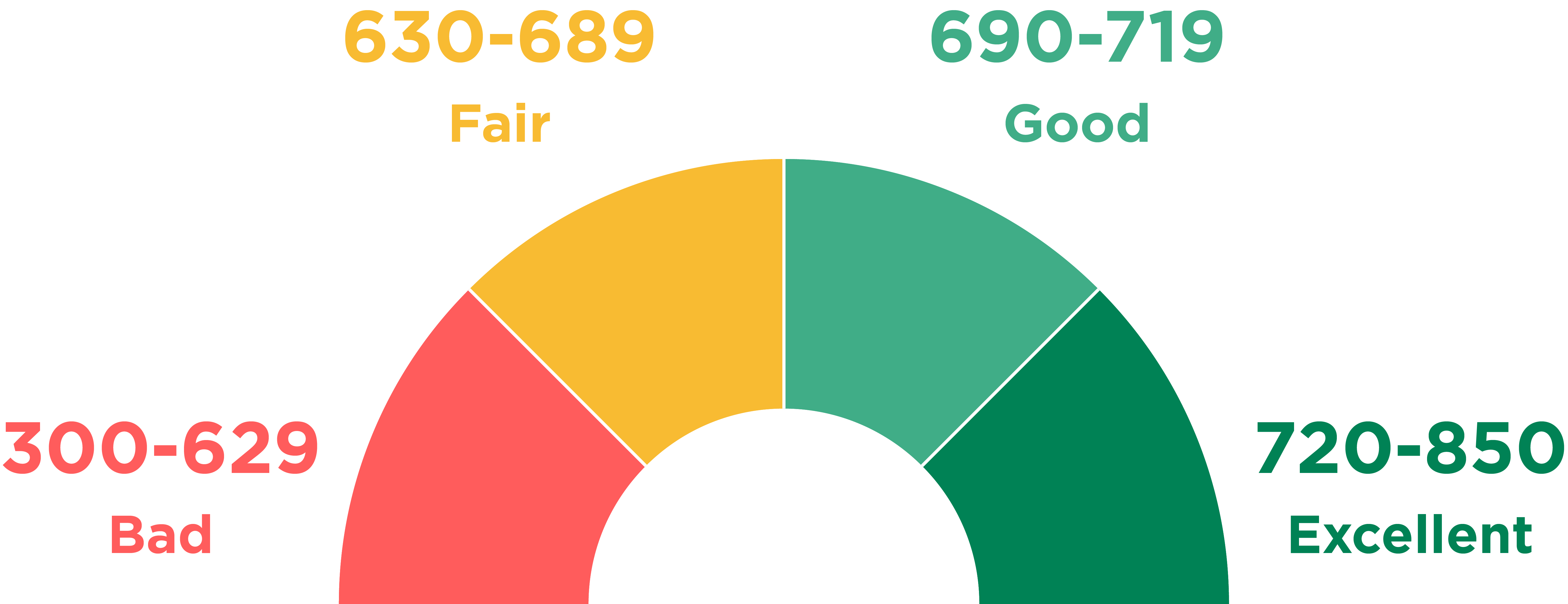

Risk comparison is a lot like credit scoring and you can exposure get

Proper out-of rescission – A provision of Information in Financing Act that gives good debtor the legal right to rescind a borrowing from the bank transaction (we.e., change his or her notice) contained in this about three working days for the one transaction the spot where the dominant home is always secure the loan.

Risk investigations – New measures a lender comes after from inside the contrasting a good borrower’s creditworthiness, fees function, and collateral condition in accordance with the new borrower’s meant use of the financing continues.

Risk advanced – The improvement regarding an effective lender’s feet interest rate as a result to help you the fresh anticipated quantity of good borrower’s borrowing exposure.

Its objective is to try to avoid an excessive amount of contact with credit risk of just one debtor

Risk rating – The brand new relative quantity of borrowing from the bank risk with the that loan purchase. The financial institution are able to use credit reporting or chance research measures to help you take a look at loan applications and you can class borrowers for the individuals exposure categories for reason for loan greeting otherwise rejection, financing rates, mortgage control, amount of keeping track of and you will amount of loan files.

Safeguards contract – A legal tool closed by the a borrower granting a protection appeal in order to a loan provider in specified private possessions sworn given that equity to safer a loan.

Higher risk loans will require a more impressive adjustment toward price differential symbolizing the chance advanced

- Blanket cover contract – A safety demand for like of your own lender layer all chattels.

Greater risk financing will require a larger changes for the rate differential representing the risk superior

- Insolvent – Debts try higher than the worth of the fresh possessions.

- Solvent – The value of the assets is actually greater than liabilities.

Stock requisite – An approach to capitalizing credit associations including the collaborative Ranch Borrowing System. The debtor must pick stock regarding lending organization to obtain a loan. The new stock specifications is literally specified because the a percentage of payday loans in Reform AL one’s loan otherwise because a dollar number. This new stock specifications could be a low while the 2% of your own worth of the borrowed funds or a maximum of $1,000. The acquisition of inventory was a financial investment on providing establishment that’s generally paid back at mortgage readiness, nevertheless the lender isnt obligated to do so.

Details during the lending – This new government Truth in the Lending Act is meant to assuring good meaningful disclosure away from credit terminology to help you borrowers, specifically into individual fund. Lenders are required to posting consumers correctly and you may explicitly of your total quantity of the fresh financing costs which they need to pay and you can the latest yearly fee interest into the nearby .01%. Excluded purchases include fund for industrial or company aim, along with agricultural fund; loans in order to partnerships, enterprise, cooperatives and organization; and you may finance more than $25,000 apart from holder-occupied, residential a property mortgage loans where conformity becomes necessary whatever the count.

Greater risk loans requires a more impressive adjustment to your rates differential representing the danger premium

- Debentures – Ties that are not protected because of the property away from a company.

- Non-rotating credit line – A line-of-credit where in fact the limit number of that loan is the overall out of financing disbursements. Costs dont build financing finance offered again as in a great revolving credit line.

- Nominal interest – The real rate of interest quoted from the financial loan providers although some.

Courtroom credit maximum – A legal limitation towards complete number of loans and commitments a loan company might have a fantastic to virtually any one debtor. The brand new maximum constantly is decided while the a designated percentage of the new economic institution’s individual web worthy of or collateral financing.

Greater risk fund will need more substantial variations toward price differential symbolizing the risk premium

- Balloon loan – Fund having occasional costs inside term of the financing, into the leftover balance from the maturity (prevent of your loan). Costs in lifetime of the mortgage get integrate only interest otherwise attract plus some portion of the principal. The latest balloon fee ‘s the last commission regarding a beneficial balloon financing and has now the latest unpaid equilibrium, and this ount.

Fees ability – Brand new forecast function out of a borrower to produce sufficient bucks so you can pay back financing together with notice with respect to the terms and conditions created in the mortgage bargain.

No Comment