30 octombrie

In whats a cash advance by vicentiu

eight Strategies for the initial-Date Home Customer

Purchasing your basic household should be pleasing-and you will tiring. Not in the issue to find the proper family on right neighborhood, you will also become grappling with financial concerns that are instead of those people you really have experienced given that a renter.

The method may seem rigorous, however for many people, the pressure off property is actually outweighed from the pleasures of owning a home

- You should never pick a property generally as the a financial investment. Even if you are now living in a location where cost routinely have appreciated, you simply can’t make sure will continue. Whether your number 1 issue is getting a monetary come back on your own domestic, other types of expenditures, like brings otherwise ties, might be healthier. Owning a home can be as much an individual investment once the a monetary you to definitely. Before you commit, assess your task balances and wish to stay in a certain location. As a rule from thumb, to acquire might not work with your favor regarding an economic perspective if you do not decide to very own a home for loans for bad credit in Maplesville AL around four years.

- Know very well what you can afford. You need Schwab Bank’s mortgage calculator to track down an atmosphere of simply how much you really can afford in order to obtain considering your own monthly earnings and other obligations. There aren’t any tough-and-prompt legislation based on how far financial obligation you could take on-even though if for example the home loan are covered because of the Government Homes Administration, your homes will cost you fundamentally shouldn’t be more 29% so you can 40% of disgusting monthly income. Whatever the calculation you employ, the key will be to maybe not excess yourself.

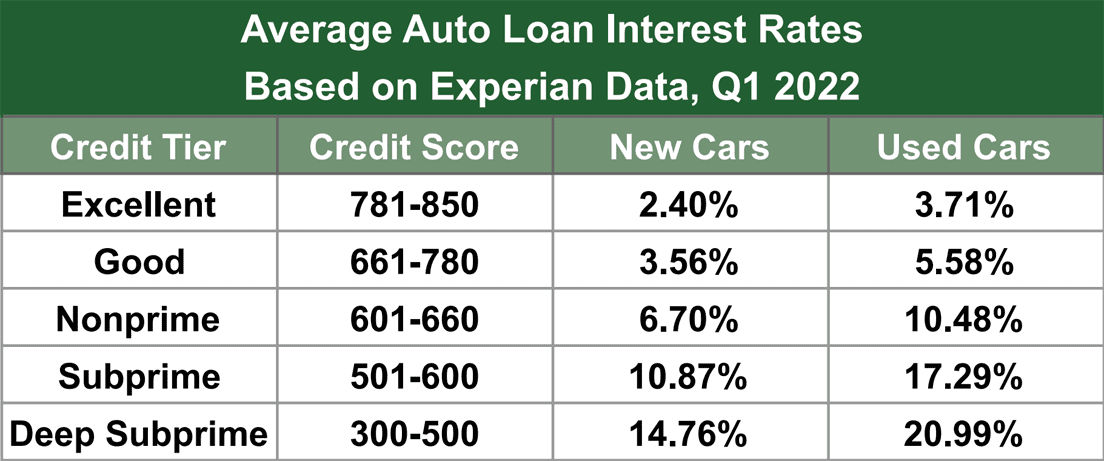

- Look at your credit history. Having a better credit score often means down mortgage pricing. While concerned with their rating, you can always do something to improve it first hunting for property. Using your costs timely and maintaining your bank card stability reasonable may help.

- See the almost every other costs with it. To acquire a home you’ll cover more than just monthly mortgage repayments. You will also have to pay property fees and will almost certainly need certainly to bring some type of homeowners’ insurance. Before buying property, you should get a house assessment, which can help you cover significant solutions like a great this new roof otherwise foundation, aside from program repair will cost you and one enhancements. If you are looking at an apartment or home into the a residential area which provides shared business eg a share, you could also need to pay month-to-month association charges. For example expenses could become a genuine nightmare in the eventuality of a position losings otherwise financial setback.

- Intend to lay out at least 20%. Your own financial might not need the full 20%, however it is smart to do this anyway. If not, your lender will probably need you to carry individual financial insurance policies (PMI). This means you’ll shell out monthly PMI superior towards the top of their mortgage payments until the loan-to-really worth proportion reaches 80%. Generally speaking, the larger your own downpayment, the easier and simpler it would be to help you be eligible for an interest rate and you can negotiate a minimal price. Along with, the greater amount of your commit to put down, the newest likelier the possibility that your own provide would-be just like almost every other estimates, as financing should be a button attention when sellers review several also provides.

- Know what files you’ll need for the loan. A number of the additionally requested files are a totally conducted arrangement from marketing to your assets becoming ordered, monetary statements for financial and you will brokerage accounts, shell out stubs, previous W2s, Internal revenue service Form 4506 (hence authorizes a mortgage lender to acquire copies off a great borrower’s tax statements straight from the brand new Irs), and you can homeowners’ insurance coverage.

- Score pre-acknowledged for a financial loan. Taking pre-acknowledged informs you just how much home you can get prior to you are going home search. As well as, it allows real estate agents and providers be aware that you’re a severe buyer because your financing has already been set-up-which can be a bonus when creating an offer.

No Comment