How quickly do you really rating a home loan re-finance shortly after to get a beneficial household?

Regardless of if you’ve purchased a house, viewing financial prices drop causes it to be tempting to help you re-finance your current loan

Cindy Couyoumjian, originator regarding Cinergy Financial and composer of “Redefining Monetary Literacy,” used the adopting the example to help you teach the period.

Having fun with an internet home loan refinance calculator can help you understand what your brand-new monthly mortgage payments is and exactly how far your you will rescue which have a lower life expectancy rate of interest compared to your amazing mortgage

“Assume the mortgage repayment was $step one,000, for those who reduce your interest by the 1%, your fee might possibly be quicker because of the $100,” she told me. “That is a great $12,000 coupons more 10 years. You really need to glance at the larger visualize when refinancing an effective domestic. A-1% lose when you look at the rate of interest is also change in order to thousands of dollars stored over the life of the loan.”

Just like any home loan re-finance, understanding the regards to your existing home loan and their home loan refinance choice allows you to make best choice. Curious about latest refinance rates? Visit Credible to obtain prequalified rates instead of impacting your credit score.

How quickly you’ll refinance your home mortgage would depend toward particular mortgage you have. However some home owners can also be re-finance shortly after to buy their home, others may have wait attacks with a minimum of 6 months otherwise lengthened.

step one. Traditional financial: If you have a normal mortgage, definition its backed by Freddie Mac computer otherwise Fannie mae, you might be permitted re-finance your financial whenever you finalized on the house.

Having said that, particular lenders have an effective “seasoning” months, that’s a fixed length of time you must hold off ahead of you might refinance your residence mortgage. In case your mortgage lender keeps a flavoring specifications, you may be able to top they by applying which have a good some other financial. Of course, you will need to make sure that your established financing doesn’t have an excellent prepayment penalty.

- FHA Financing: When you have an FHA mortgage (insured by Government Casing Government) and wish to refinance from the securing yet another FHA financing, you certainly can do what is named a personal installment loans in Massachusetts keen FHA Streamline Re-finance. It’s a hold off chronilogical age of 210 weeks on the totally new loan’s closing day but has no need for another type of appraisal. Whenever you are in search of an excellent cashout refinance, for which you take-out another type of mortgage getting an enthusiastic amount higher than your balance on your latest mortgage and you may pouch the difference, you ought to lose your house as your top residence to have at the least 12 months.

- Va Loans: When you yourself have an effective Virtual assistant financing (supported by the fresh new Service away from Pros Circumstances), you must hold off 210 days otherwise an occasion that’s anticipate your plenty of time to make six money.

- USDA Fund: Good USDA loan (backed by the latest You.S. Institution out-of Farming), necessitates that your instalments be produced on time getting 180 months before making this new re-finance demand. Simultaneously, your existing mortgage need to have finalized one year prior to opening brand new USDA refinance demand. After that, homebuyers need meet the USDA’s financial obligation-to-money proportion and you can borrowing from the bank standards, therefore the limit loan amount do not surpass the initial amount borrowed during pick.

Possess questions relating to refinancing your own mortgage? Contact Credible’s educated financing officers and get the latest responses need.

Immediately following plunging in order to 50-seasons downs when you look at the , interest levels rebounded and you will hover near step three%. Cost are required to keep during the latest levels because Federal Reserve launched so it plans to continue enough time-label borrowing from the bank cost low forever. Home loan cost enjoys barely grown above 5% since the 2008 recession, and also the Federal Organization out-of Real estate agents expects costs usually average step 3.1% having 2021, up out of 3% when you look at the 2020.

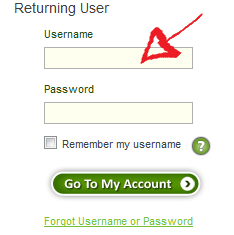

If you were to think refinancing ‘s the correct flow, consider using Reputable. You can utilize Credible’s free online tool in order to without difficulty compare numerous mortgage lenders and find out prequalified refinance rates into the less than 3 minutes.

No Comment