Ought i make use of the local rental income of a two-to-4 equipment locate home financing?

- $9,900 x 30% = $3,070

To possess testing, in the event that Ada would be to get a flat, the quintessential she you certainly will afford to spend every month could be $2,325. With no leasing income, the total amount Ada can acquire minimizes most.

Because Good-a great is interested from inside the a multiple-family home, the long run leasing income develops their to invest in fuel, enabling her in order to borrow a great deal more with her financial.

When selecting a 2-to-4-device house, you can utilize the long term rental income in the assets to help you qualify for the mortgage. Still, the principles are very different according to the brand of mortgage you use.

FHA mortgage: The lender could add around 75% of your lease you would expect to get towards the qualifying income, to make providing approved into the loan much easier. For example, purchase a good duplex, and leasing device stimulates $step 1,000 month-to-month. This is why, you can $750 towards the monthly being qualified earnings.

Traditional financing: Simultaneously, the financial institution could add up to 75% of the rent you would expect to get on the being qualified income. Although not, there’s you to tall restriction – you truly need to have an initial living costs, such as for instance a mortgage or lease fee.

The lending company usually verify that you have made casing costs having at least 12 months just before letting you explore coming rental income throughout the dos-to-4-equipment possessions whenever qualifying toward home loan.

The following desk suggests if or not you can include a portion of the future local rental money regarding a 2-to-4-unit assets for the qualifying money to obtain approved getting a conventional loan.

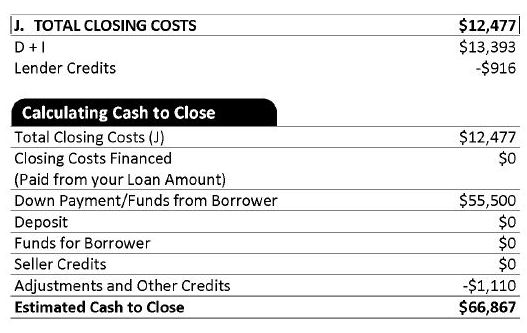

Figuring out how much a multiple-friends property will set you back was an important first rung on the ladder inside property. To invest in a house requires more than just their month-to-month mortgage repayment. Before surely offered to get a multiple-house, you will need to influence the degree of their deposit, closing costs, and you can monthly premiums.

To have consumers, mortgage costs are usually split into several wide kinds: your payment and your bucks to close off. Cash to close off refers to the advance payment and you can settlement costs owed when you personal in your domestic. Your payment stems from your lender each month because the you pay back the loan.

Buying a multi-home, you will need 3.5% of the price toward advance payment. You’ll be able to spend your own down payment toward provider because you romantic on your the assets, and also the leftover quantity of the cost is what you acquire out of a lender.

If you buy a great 3-flat to have $five-hundred,000, you prefer $17,five-hundred towards the deposit, that’s step three.5% of your own purchase price. After that, borrow $482,five-hundred away from a home loan company for example newcastle.financing.

You simply can’t borrow funds to pay an advance payment and take out a cash loan out-of a credit card. Essentially, if you’re unable to establish the place you got the cash, the financial institution won’t count they for the the money you’ll want to romantic into home.

Could you rent, individual, or alive book-free?

In addition to the downpayment, settlement costs is the fees you pay when buying a house. Although different charges get into it umbrella, you should anticipate the fresh new settlement costs to may include dos-5% of your own purchase price.

Seeking coming rental money getting a traditional loan?

When you along with your real estate professional negotiate the sales price, query the vendor to blow some otherwise all closure will set you back. If you find yourself suppliers can be ready to defense these settlement costs, they can’t pay people area of the deposit.

You may need supplies when selecting property which have step 3 or cuatro tools. Reserves was loans you have got remaining just after closure. Normally, lenders wanted 90 days of one’s property commission in set aside to own unforeseen opportunities, repairs, or costs your incur since the a different manager.

No Comment