Classes of Skyrocket Mortgage: create a crossbreed financial techniques

The new meteoric development of Rocket Home loan has actually displayed just what mortgage officers must do to keep are aggressive on markets of tomorrow. The clear answer? Follow a crossbreed mortgage credit processes.

A hybrid home loan means combines the conventional, relationship-heavier, lending process having today’s technology geared towards boosting and you may streamlining the process. Below, we shall guide you how-to do so.

They certainly were what away from Quicken Loans’ captain economist, Bob Walters. Regardless if Quicken Fund / Rocket Financial began $79 billion when you look at the 2015 home loan regularity, we think the new part of financing officer isn’t really dying, it positively needs to develop.

The latest mark in order to Rocket Mortgage: financial automation

See between your contours and is obvious what Most pushes the home loan lending power: automation and you https://www.paydayloanalabama.com/chunchula may results.

The outcome was impractical to skip. Nonbank lenders, such as for example Quicken Loans, have observed its display of your residential mortgage , these types of nonbank loan providers got its start 23% of the residential home loan one count had grown so you’re able to 43%.

They’ve developed a network making it possible for a prospective borrower to submit the newest files needed seriously to get an enthusiastic underwriting choice. Money, assets, debts, credit ratings, etc is actually automatically removed to the system if you’re advanced algorithms functions behind the scenes to create some mortgage possibilities.

Automated document and you may investment recovery by yourself is a huge mark (read: time-saver) to own consumers, nonetheless also add on the specific nice has eg eSignature and personalized pre-acceptance emails for consumers.

Problems with Rocket Home loan: diminished provider and home loan options

Believe it circumstance: you’ll get ready to get property, you will be making the Quicken Loans membership, enter a guidance and you may pull all earnings and you will possessions towards program and you will voila you really have certain financing information.

Today the fun begins! Having Rocket Mortgage, the customer can tailor their mortgage solutions from the adjusting slider bars to possess things like settlement costs, financing terms and rates of interest.

This is so that fun! I have had my personal finest mortgage settings, today let me hit the See if I am Approved button aaaaaaaannnnd: Denied.

The actual only real alternative at this point is to help you simply click another type of key to speak with a call-cardiovascular system mortgage broker who, without knowing something in regards to the debtor, will attempt to determine what happened. So much having punctual and you may successful.

For someone and work out what exactly is potentially the largest purchase of its existence, this is just not appropriate. The problems developing listed here are exactly what quick the need for a great crossbreed mortgage procedure.

Which call centre including might trying to complete the fresh new character your mortgage administrator keeps in the a vintage function: pointers and you may suggestions for the an elaborate and psychological exchange, answers when you really need them, experience in the new underwriting conditions must ensure you get your loan recognized, together with follow-through had a need to allow you to be closure.

The mortgage officer is even a member of the neighborhood. Capable generate ideas on regional Realtors, when you should re-finance, or assist you with a property collateral or HELOC (facts Quicken/Rocket cannot offer) when the time is great.

Incorporating tech to your a hybrid mortgage techniques

The main is to learn from the instruction coached by the borrowers using the the means to access Rocket Financial: borrowers wanted a simplified and you can streamlined procedure, which have much easier usage of suggestions, and you will today’s technology from the their disposal.

These are characteristics one to financing officer Provide, towards proper possibilities in place, while also including astounding worthy of regarding a 1:step 1 connection with individuals.

The point-of-income

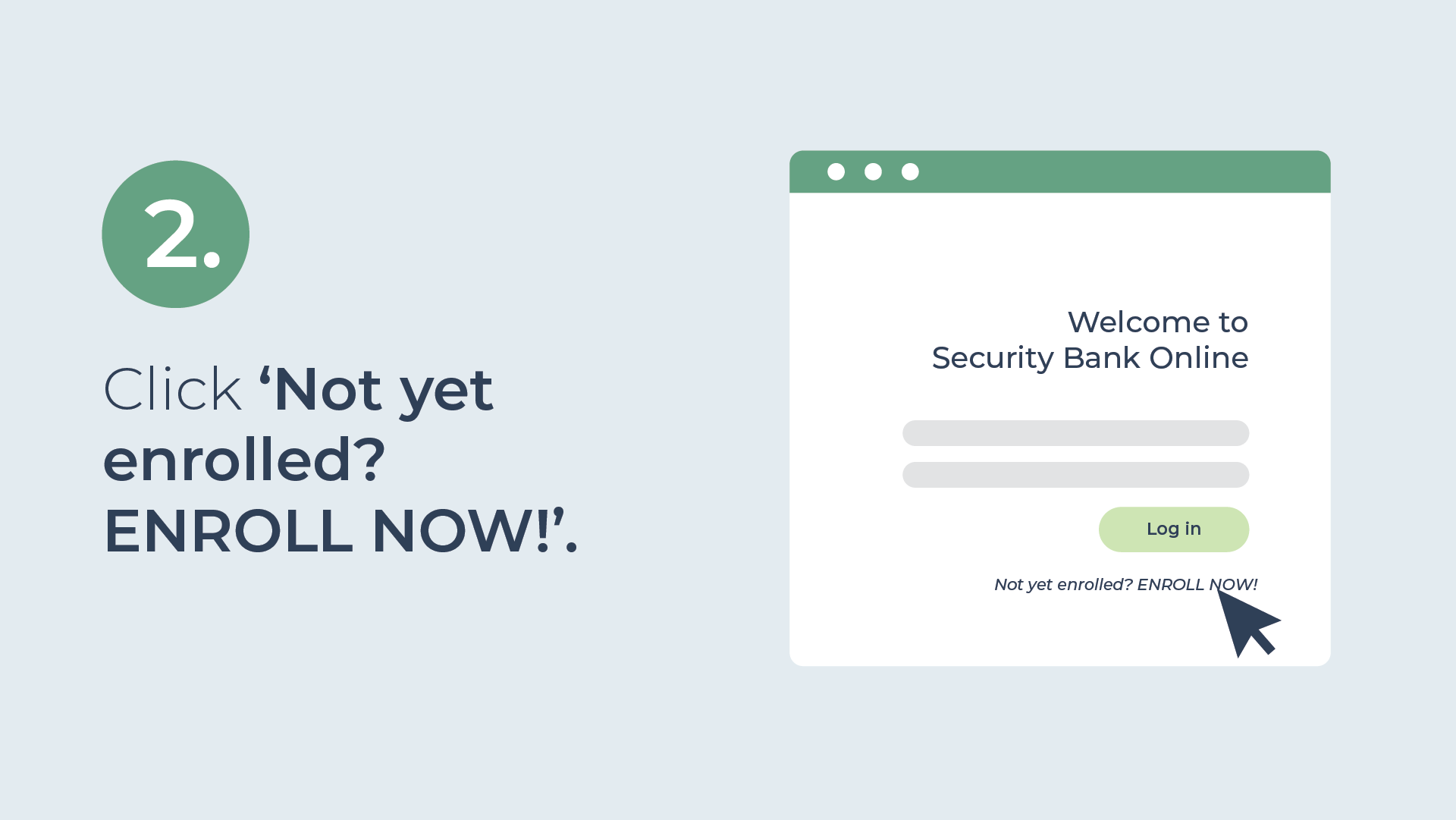

The brand new POS is an excellent instance of the pros good LO normally enjoy of the adding complex tech to their origination process. The present day mortgage part-of-selling has got the technological efficiencies and mobile-amicable sense one to individuals appeal:

- Intuitive and you may safe portal so you can improve file collection.

- Provided functions having buying head-resource borrowing from the bank, assets/deposits, work, and you may income verifications.

- Automatic mortgage condition reputation to keep individuals advised regarding whole procedure.

- eSignature.

- Directed, interview-style loan application.

- Cellular app w/ photos upload possibilities.

Just really does the latest POS program do-all regarding the getting new borrower, although tangible benefit to the borrowed funds inventor lets these to rating that loan file on underwriting faster, with high amount of reliability. All this conspires together to simply help get funds financed smaller and you may much easier than just through legacy procedure.

This will be every individuals are really asking for, and just why they have turned to the fresh new Quicken Loans’ / Rocket Mortgages of the world. The latest stress is placed on efficiency and you may openness.

The bottom line

You dont want to getting Skyrocket Financial. The reason for Skyrocket Mortgage should be to generally take away the loan administrator throughout the mortgage origination processes. But not, it is impossible to ignore the development off nonbank lenders such as for instance Quicken Finance. That progress increase features presented the newest recommendations an individual are requiring that the business circulate: send.

Towards the introduction of new tech and you may applications for example Fannie Mae’s Date step 1 Certainty, it is certain that the industry features heard this new warning bells noisy and obvious. You must develop, or you will getting approved by the crowd.

No Comment