Cracking Barriers: Financial Resource to own Manufactured Homes from inside the Tribal Communities

Homeownership is a huge difficulties in several Indigenous American teams. Considering Census analysis, from the 50% out of Indigenous American houses own their homes as compared to national average out of 65%. For these doing work in sensible housing to your tribal lands, understanding the available home loan resource selection and exactly how it partners that have modern were created homes may help link so it pit and you may help green homeownership in these teams.

Are produced home offer a fees-effective and versatile solution but funding them can be an excellent hurdle. To handle so it, multiple home loan items are specifically designed to get to know the requirements of Native American homeowners searching for to invest in yet another facility-situated domestic. This type of programs render certain pros, such as for instance lower down payments, access to property counseling, and eligibility having deposit direction, causing them to rewarding devices to have expanding homeownership rates on the tribal countries.

As to the reasons Are produced Houses?

The current are built belongings are professionally constructed inside the authoritative home-building place according to the supervision from globe experts. Strengthening such residential property when you look at the a plant allows deeper quality-control and provides a quicker, a great deal more rates-energetic homes solution versus website-founded home.

This type of land try built having fun with certain same product because the site-based property and include advanced times-efficient features. Time Celebrity-certified were created belongings have appliances and you may highest-show comfort assistance that can help home owners cut back to 29% toward monthly tools.

Home loan Alternatives for Local Americans

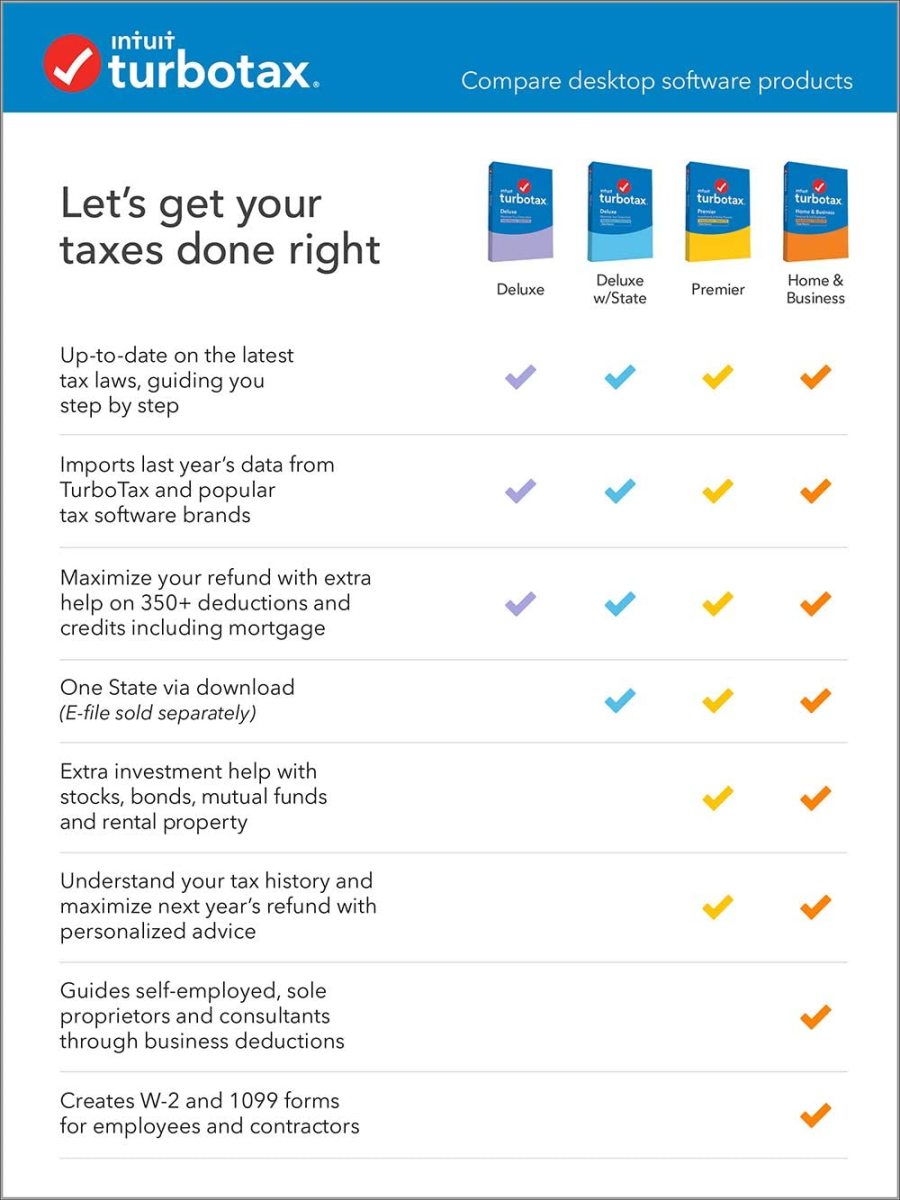

Several designed resource software are formulated specifically to deal with exclusive needs from homeownership into tribal places. Each system also offers type of positives and requirements level numerous items.

HeritageOne? Home loan | Freddie MacThe HeritageOne home loan product is a finance solution specifically made for people in federally accepted Indigenous Western tribes residing tribal parts. It includes consumers which have accessibility traditional investment getting homes located within eligible Local Western tribes’ tribal components.

- Homebuyer Pros: HeritageOne financing possess down costs only step 3%, lack money limits, and will become together with homebuyer apps for example deposit assistance.

- System Requirements: To help you meet the requirements, one borrower should be a person in a great federally recognized group, additionally the family should be from the tribal section of an eligible Indigenous Western group. First-go out people have to complete good homebuyer knowledge course and will perform very owing to Freddie Mac’s totally free homeownership education course, CreditSmart Homebuyer U.

- Qualified Features: Fund are often used to pick are made homes, a 14-equipment prient, or a property having an ADU. They can’t be employed to get the second family.

Point 184 Indian Construction Financing Be sure Program | HUDThe Section 184 Indian Financial Make sure System is a property home loan equipment specifically designed to have Indian native and you may Alaska Local household, Alaska towns, tribes, otherwise tribally designated housing agencies.

- Homebuyer Advantages: Individuals make the most of down payments not as much as 3%, mortgage based on the business, maybe not the fresh applicant’s credit rating, and you can hand-to your underwriting sense.

- Program Standards: Part 184 loans can only just be used by acknowledged loan providers inside acknowledged counties. The mortgage are often used to purchase a home, rehabilitate otherwise re-finance a current family, installment loans in Salt Lake City UT with bad credit or create weatherization condition.

- Eligible Qualities: Area 184 loans can only just be studied getting unmarried-relatives belongings, along with are manufactured residential property on the a permanent base. The home can be used due to the fact an initial quarters.

Part 502 Head Financing System | USDAThis financing program support reasonable-and extremely reasonable-money people within the getting decent, safe and hygienic houses during the qualified outlying section by giving percentage assist with increase their repayment feature.

- Homebuyer Positives: There’s normally zero downpayment necessary, and therefore mortgage program is a kind of subsidy that briefly reduces the home loan. Loans are often used to make, resolve, renovate, or relocate a property or even pick and you can prepare internet, in addition to bringing water and you will spend procedures products.

- System Requirements: Just features in the a qualified rural area be eligible for this option and you may people need satisfy earnings eligibility to possess a primary mortgage.

- Qualified Attributes: Properties is employed once the buyer’s no. 1 household and can’t provides an industry value over the new relevant city mortgage limitation.

Veteran’s Points Indigenous Western Direct Financing (NADL) Program | VAIf a veteran or their partner try Indigenous Western, the VA’s Local American Direct Loan (NADL) system provide a loan to find, create, otherwise boost a house towards government trust homes. The loan can also be used so you can re-finance an existing NADL and relieve the speed.

Native American Homeownership Initiative (NAHI) | Federal Financial Lender (FHLB) De l’ensemble des Moines, IAThe Native American Homeownership Initiative try a down-payment and you will closure costs guidelines program provided by FHLB Des Moines in order to qualifying Local American, Native Alaskan and you will Indigenous Hawaiian homeowners compliment of member creditors.

Get it done

Financial financing choices are accessible to help to make homeownership much more achievable to possess Indigenous Americans. Whenever these types of options are used to buy an alternate are produced domestic, they offer a path to alternative homeownership that can assist personal the newest homeownership pit to the tribal lands.

Those people in developing reasonable housing toward tribal homes should acquaint on their own to your available options to raised discover their pros and you may requirements. Even after its differences, for each and every financial support option provides safer possibilities having homeownership, resulted in the opportunity of building generational riches.

No Comment