The new Orleans Homebuyer’s Self-help guide to a premier Credit score

Having a credit rating in the 650 range may have significant implications for new Orleans homebuyers trying home financing as opposed to those having high otherwise lower ratings.

Fantasizing of shopping for a charming shotgun house from the brilliant city of new Orleans? A leading credit rating will be your key to unlocking that dream! This article equips you toward training to alter their borrowing rating and you will unlock the door to homeownership in the Huge Simple. Explore basic actions and see your credit rating soar, paving ways for your NOLA dream household!

What is actually a credit score?

This means that, your credit rating is actually a picture of one’s creditworthiness. It is a mathematical icon, typically between three hundred in order to 850, centered on your borrowing background, installment behavior, and you can total credit management. View it just like the a research credit issued by credit agencies for example Equifax, Experian, and you can TransUnion. It collect factual statements about the money, playing cards, and you will commission activities, viewing it to make your credit rating.

Which rating acts as an initial perception to own loan providers, landlords, and also insurance vendors. A leading credit rating (fundamentally over 740) is short for in control economic management, potentially giving you use of finance with favorable conditions, straight down interest rates, and even most readily useful insurance costs. Likewise, a reduced credit history normally limit your use of credit or produce highest interest levels, and then make borrowing costly.

What the Credit history Function

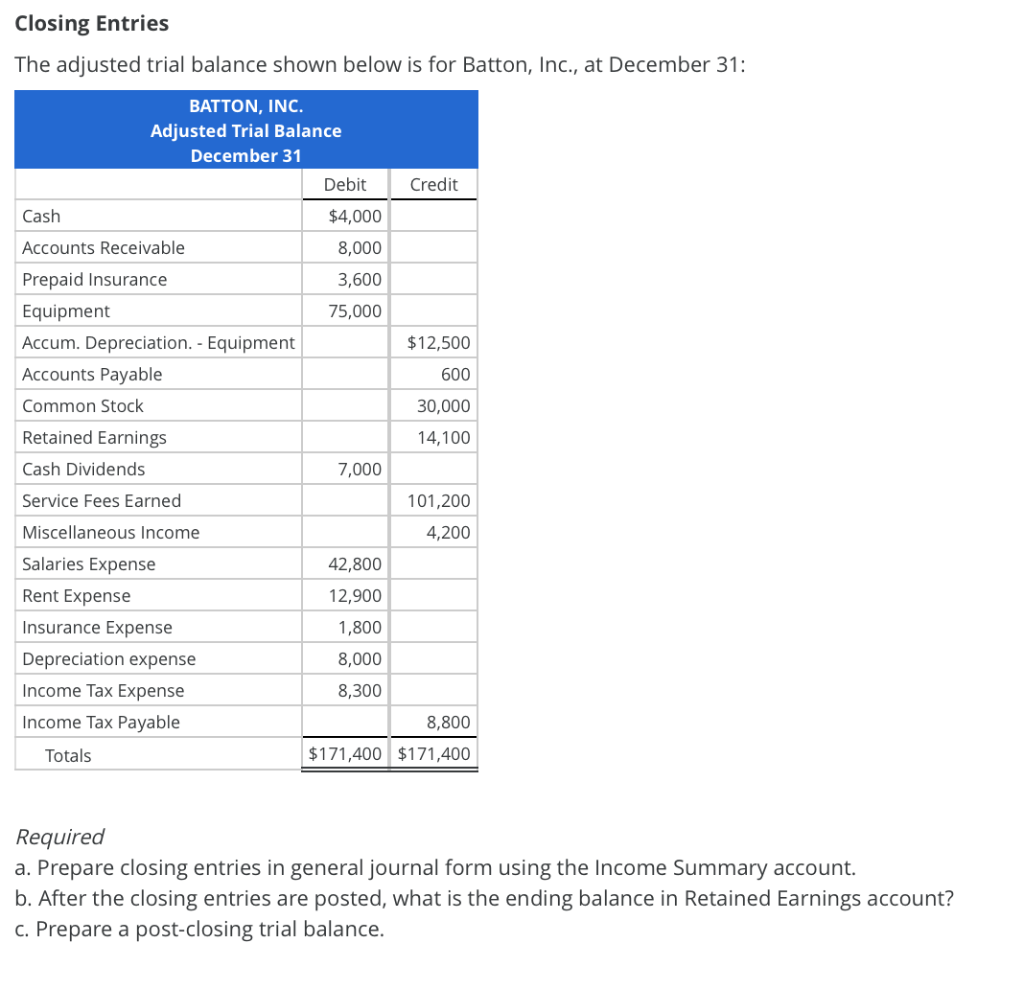

In the us, mortgage lenders typically have confidence in the FICO score design, and this selections out-of three hundred so you’re able to 850. It matter functions as a simple sign of your creditworthiness, that have increased rating signifying better monetary activities. Here’s an article on exactly what your credit score form:

- 3 hundred in order to 579: Less than perfect credit It variety means a distressed credit rating, potentially limiting your loan alternatives and you may causing rather higher desire rates.

- 580 to help you 669: Reasonable Borrowing from the bank Although you may be eligible for particular loans, rates can still getting unfavorable.

- 670 to help you 739: Good credit This is the beginning of an appealing diversity for loan providers, giving you entry to a larger set of mortgage options and possibly all the way down interest levels.

- 740 to help you 799: Very good Borrowing from the bank This rating unlocks a whole lot more good financing terminology and you can somewhat lower interest rates, saving you profit tomorrow.

- 800 to help you 850: Advanced Credit Well-done! So it best-tier get features your use of many glamorous financing options in addition to low you can rates.

The new feeling of your own credit score surpasses only being qualified to possess a loan. They privately impacts the brand new conditions therefore the sized their monthly home loan repayments. While the difference in monthly premiums anywhere between someone with expert credit and you may some one that have bad credit may sound short initial, throughout a thirty-seasons home loan, it can snowball for the thousands of dollars spared (or forgotten) in interest. Ergo, maintaining good credit is an effective equipment getting protecting currency and having debt needs.

What are the greatest seven issues that apply to your credit score?

- Commission History (35%): Here is the solitary biggest foundation impacting your credit score. They considers exactly how punctual you make your instalments to the playing cards, financing, book, resources, plus cell phone bills. A track record of towards the-day payments rather increases their get, whereas missed otherwise later money may bring it off.

- Credit Utilization Proportion (30%): So it ratio indicates how much cash borrowing from the bank online payday loan Connecticut you’re using than the their complete credit limit. Its calculated by the separating their full bank card balances by your total credit limits across the most of the cards. Preferably, you want to bare this proportion less than 29% for proper get. Maxing your credit cards or with a leading use ratio shows defectively on your creditworthiness.

No Comment