Why money fashion number for the financial statement mortgage computations

- Companies having no group: 20% costs proportion

- Enterprises that have step 1-5 employees: 40% debts proportion

- Organizations with well over 5 teams: 50% debts ratio

Around this technique, you will additionally need to bring your own latest 12- or 24-months’ bank comments and you can a business bundle and other data files explaining more info regarding the team.

The lender will cautiously at the lender comments and work out yes distributions was consistent with the projected debts ratio. If your lender statements imply a price ratio in excess of 50%, the financial institution will use another type of means otherwise send the application form in order to a totally some other financing system.

It is vital to have the ability to show certain stability of income. Whatever the strategy, the lenders can look during the how your income trended across the last 12 to help you a couple of years. In the event your trend was upwards, all of the was well. In the event the earnings features dropped, however it keeps stabilized has just, you may have to promote specific considerably more details into the financial to demonstrate your money might possibly be secure from this point submit which will be not likely so you’re able to weaken subsequent.

If for example the money enjoys fell, and overall declining development was continued and also perhaps not found signs and symptoms of stabilization, the financial institution may turn down their bank statement application for the loan (however s, such as for instance a good no ratio’ financing.

Partnering financial comments with other offer getting loan formula

These methods are in addition to most other income offer that will be noted just like the Full Doc not regarding the self-a position. Such as for instance, you may be worry about-working and employ one of these approaches to demonstrate income for the introduction to some W-dos and other verifiable earnings.

You are able to keeps an excellent co-candidate on the loan having personal taxation yields, an effective W-2, and/and other more conventional different earnings verification. The financial institution have a tendency to combine all the information to make it to full verifiable income, otherwise obtain a larger picture of your general problem and you can what you can do to support the mortgage.

If you don’t have a great CPA

Without having good CPA or any other tax preparer so you’re able to help you with files, you can nevertheless possibly be eligible for a home loan. Of many advertisers i work at enjoys many money, but do not daily use an effective CPA or keeps months away from detail by detail profit-and-loss statements in hand.

If you’re in this situation, particular loan providers are willing to forego the fresh preparers’ statement. Alternatively, might go through your financial statements and you can subtract the business’s withdrawals throughout the dumps per month. Might multiply the end result by the control fee in the market to guess the pro-rata money.

Conclusion

Self-employed individuals and small businesses shouldn’t be frustrated whether it concerns to find or refinancing property. Whether you’re thinking of buying otherwise re-finance a proprietor-filled residence otherwise and get or refinance a residential property, will still be possible for self-functioning individuals to qualify for a very competitive home loan.

At DAK Home loan, i specialize in notice-employed individuals, business owners, buyers, non-You.S. citizens, and other activities wanting financial flexibility and creative options.

Whenever you are self-operating, a business owner, growing off case of bankruptcy otherwise foreclosures, or if you you prefer an away-of-the-box financing provider, we want to assist you.

Delight contact us within 321-239-2781 or [email address protected] or from the pressing right here for additional information on these powerful and you can flexible lending apps designed particularly for worry about-working some one.

The financial institution have a tendency to number lead transfers out-of web business loans Starkville CO money away from your online business account(s) into private account(s) just like the earnings for purposes of qualifying for the financial.

Once again, lender places need to be inside +/- 10% of P&L statements. But not, if you’ll find inaccuracies in one or more weeks, you may want to fill out even more straight bank statements until places and you can P&Ls try for the ten% demands.

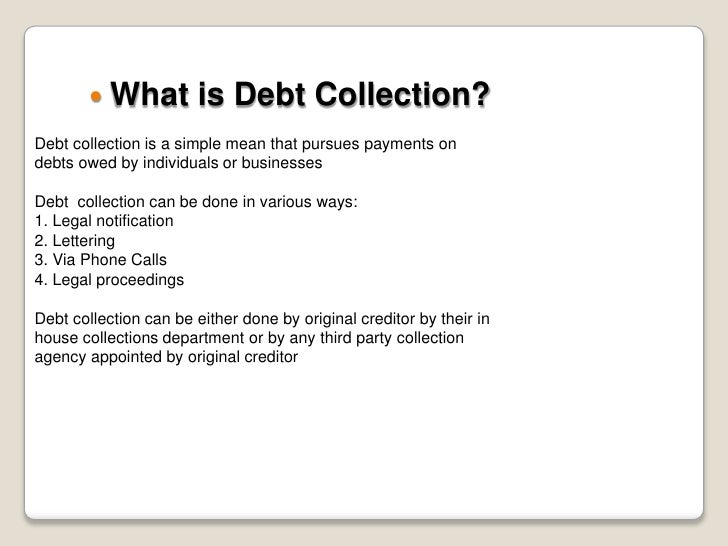

For product-built people, the financial institution have a tendency to imagine their costs equivalent fifty% of one’s terrible income. Having provider enterprises, the lending company will generally estimate your own expense proportion having fun with a moving scale according to the quantity of team. Just to illustrate from one of the lenders we quite often really works with:

No Comment