Be mindful of These types of Va Assessment Items

Minimal Possessions Requirements

They put market really worth in case the wanted property fits the latest VA’s variety of limited possessions criteria (MRPs). Such standards destination structural, foundational, and other family facts before generally making the acquisition during the closure.

However they require also owner to resolve these problems, increasing the home’s conversion process rate. A normal home review cannot request the vendor to fix people products which sacrifice the house or property. you would be best if you comment that normal check records together with your real estate agent.

Economic Protection

The VA’s jobs which have appraisals is to try to be sure they include your, the lender, and you may by themselves. They want one to get to the American Dream by residing in the latest fantasy house you fought so hard getting. Please remember all household you’ve forfeited to have so they really you certainly will increase their students from inside the a youthfulness house.

But they does not chance your money and you can future comfort from the investment a home you to reduces. You don’t want to settle off together with your retired spouse or more youthful friends just to come across several thousand dollars in home repair.

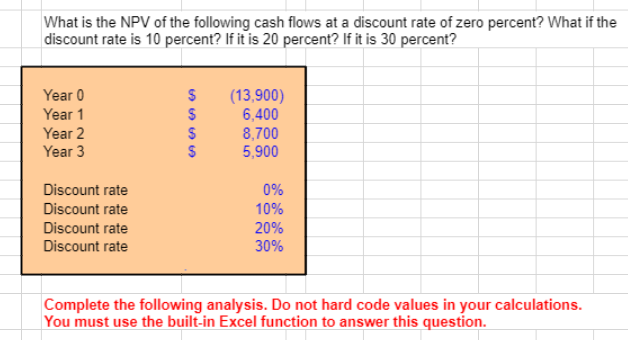

Va Appraisal Fees

Virtual assistant appraisal fees are very different according to several things, such as the location of the assets, the sort of assets, as well as the complexity of your appraisal. But not, you will find several general direction:

- Single-family members home: The average percentage for a great Va assessment of one-family home try ranging from $400 and you will $step one,2 hundred.

- Condominiums and you can are formulated belongings: The typical commission getting a great Virtual assistant assessment away from a beneficial condo or are built residence is a little below the cost having one-family home, usually anywhere between $300 to $step 1,000.

- Multi-device characteristics: An average fee getting a beneficial Virtual assistant assessment out-of a multiple-device possessions, such as for example a duplex otherwise triplex, is higher than the price getting a single-home, normally creating to $500.

In addition to the ft percentage, there’ll even be most charges for take a trip expenditures, if the property is discovered from the latest appraiser’s office, or even for cutting-edge appraisals, like appraisals away from historic belongings or functions that have thorough renovations.

After an excellent Va Domestic Bank will provide you with an official loan page, you could start looking and set the deal off. You need to see the second situations on the Virtual assistant Assessment pursuing the merchant agrees into the render plus the assessment happens.

House Fix Estimate

Once more, the us government appraiser will demand the vendor to solve one requisite hazards otherwise family circumstances in lieu of an evaluation. We want to underline and you will stress those things so that you and you can the seller are on the same page for what has to happens.

They may plan to straight back out-of attempting to sell payday loans Saks the house in order to your because of the Virtual assistant Appraiser’s needs. The new appraisal can result in setbacks home based repair instances, nevertheless will last as well as your loved ones on the a lot of time work on.

Isolated Advancements

The advantage of Virtual assistant Appraisals is the fact many times the latest appraiser will include isolated advancements within the home’s complete really worth. For this reason, they will glance at swimming pools, sheds, or other features you to definitely family inspectors won’t.

We wish to consider it you and your partner is also intentional for the domestic buy. Our home could be best, although isolated advancements might be a top priority for how your appreciate domestic lifetime.

Physical Handicaps

Virtual assistant Appraisals are great as they envision any wounds or real disabilities you really have gotten from service. It make sure the matches you’ve fought for the country cannot bar you from viewing retirement otherwise an initial family get.

Your residence loan case perform then meet with the VA’s importance of are part of Particularly Adjusted Homes (SAH). You need to get in touch with A nearby Loan Center (RLC) in Phoenix for particular questions about how the inspector tend to accommodate their handicaps.

No Comment