QuickBooks Online Pricing: Upfront & Hidden Costs Explained

You can create an unlimited number of invoices and estimates, track your expenses and manage up to 1,099 contractors. You can bring live bank feeds into your account and access a range of third-party integrations. For the latest information on pricing and promotions, visit our pricing page. If you work with an accounting professional, you may want to speak with your accountant or bookkeeper prior to signing up for any possible discounts or packages. Many accounting professionals also offer set-up services, ongoing support, and advisory services to help your small business work successfully on QuickBooks. Plus supports up to five users, giving you the option to configure their access.

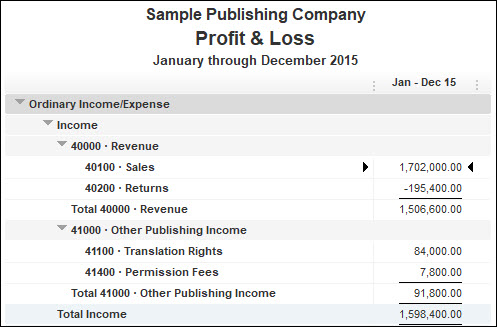

QuickBooks Online Pricing Plans

If you run businesses in multiple locations and want to see which one is most profitable, an upgrade to Plus from Essentials is worth the price. The QuickBooks Online comparison chart below highlights some of the key features of the five versions. We include in-depth, side-by-side comparisons of each plan against its next-level tier in the sections that what is an invoice number follow. If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work. Another difference between QuickBooks Enterprise vs. Online is their pricing plans. Today, you’ll weigh up QuickBooks Online vs. Enterprise — two of Intuit’s most powerful solutions.

Tax Forms & Support

All Platinum features, plus Assisted Payroll to handle federal and state payroll taxes filings for $1/employee each pay period. Users can also add a Salesforce CRM connector for $150/month and QuickBooks Time Elite for $5/employee each month. Business banking, estimates and invoicing, payment processing, cash flow tracking, basic reporting, mileage tracking and basic income and expense tracking. Our partners cannot pay us to guarantee favorable reviews of their products or services. Hopefully, knowing the exact costs of QuickBooks Online will ease your mind and help you create a more realistic business budget. If you want to learn more about QuickBooks, read our complete QuickBooks Online review or get started with a free trial.

QuickBooks Desktop, on the other hand, is locally installed with a license pricing model. Before we dive into the details of each QuickBooks plan and its value, here’s a look at the latest accounting software deals and discounts from the biggest and best QuickBooks alternatives on the market. You’ll be able to track bills, set up recurring billing, track expenses, record payments in multiple currencies, and scan bills to keep abreast of all the money your company is owed. Similarly, you can create a client database and track overdue client payments to keep on top of who owes you what.

QuickBooks Online Essentials

- Larger businesses with substantial accounting teams may want to consider the QuickBooks Advanced plan.

- With five plans, each at different price points, users can choose the plan that best meets their business needs without paying for additional features that they don’t want.

- It is also suitable for those doing business outside the US, as it supports multiple currencies, unlike Simple Start.

- For instance, with QuickBooks Online, your security is handled by QuickBooks.

- QuickBooks Online also offers more automation features, which might be a better fit for small businesses — the more tasks you can delegate to the software, the more efficient your business will be.

- The QuickBooks Online plan that’s best for you largely depends on the number of users who will be using the program, the size of your business and your particular needs.

You can create basic asset and liability accounts in the chart of accounts (or use the existing ones) to track things like bank accounts, cash on hand, A/R and A/P, credit card balances, and loans. If you use QuickBooks Payroll, payroll liabilities like what is obsolescence in accounting chron com taxes and deductions will be tracked automatically. QuickBooks Online offers four standard plans—Simple Start, Essentials, Plus, and Advanced—with prices ranging from $35 to $235 per month. They vary in the number of users and features included and are built for different purposes. The QuickBooks Online plan that’s best for you largely depends on the number of users who will be using the program, the size of your business and your particular needs. If you are a small business or a startup, consider QuickBooks Simple Start.

Is QuickBooks Online a better deal than QuickBooks Desktop?

Standard accounting tools, including invoicing and payments, income and expense tracking, bill management and basic reporting. If you’re shopping for QuickBooks as a small-business accounting solution, first absolute drywall inc drywall contractor decide whether you’d like online, cloud-based software or a desktop product that locally stores your information. QuickBooks pricing varies quite a bit depending on which product you choose and how many users you need.

Your business size and structure will determine which QuickBooks Online plan is best. If you’re a single freelancer, you won’t need to manage any other employees, and you won’t need to track many sales (if any) – so the Self-Employed Plan is best for you. We’ve ranked the best self-employed accounting software, and QuickBooks is at the top. Setting up the software involves plenty of one-time tasks that you’ll want to get right the first time, like connecting your bank account and setting up a series of automated processes and templates. Through Live Bookkeeping, you’ll get a single one-on-one session that can clear up any questions and start your accounting software subscription off on the right foot.

As a business grows, users can easily upgrade to a more advanced plan with additional features seamlessly. QuickBooks is the platform most used by professional accountants so if you plan to work with an accountant, they will likely be very familiar with the platform, its features and capabilities. All of these small costs can add up, making your end bill higher than the predictable $35-$235/month fee. Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance. This takes into account customer management, revenue recognition, invoice management, and collections.

Its basic plan is in line with QuickBooks Simple Start, at $15 per month. Although QuickBooks Online is a great cloud-based accounting platform, it isn’t the only one. Available in industry-specific editions; includes inventory management, advanced reporting, job costing, priority customer service and more.

As mentioned earlier, QuickBooks Solopreneur is excluded from our evaluation since it’s not a double-entry accounting software. The tier provides greater flexibility in customizing reports than the other QuickBooks Online plans. Users can tailor their reports by filtering and grouping data and creating custom fields and dashboards. Additionally, Advanced lets you generate multi-company reports and schedule emailed reports to be sent to specified email addresses.

No Comment