How to get Preapproved to own a Va Mortgage – Actions

Maker off SoCal Virtual assistant Land

A great Va loan Preapproval within the finest function is actually an authentic conditional dedication to give, given away from a Va loan underwriter, doing work for a loan provider. Once you’ve hit your own Virtual assistant loan preapproval, you’re indeed happy to purchase and https://availableloan.net/installment-loans-ma/lawrence/ you will close punctual, so long as the home fits the latest lender’s requirements.

But not, not all loan providers often underwrite an effective Virtual assistant loan file that have good property To get Calculated otherwise TBD. Which most crucial action is significantly out-of performs, and it may perhaps not develop a closed mortgage while there is maybe not assets but really. This has been an unnecessary even more step. Yet not, getting Va individuals with limited credit the other effort is extremely needed once the credit reports was already reviewed of the underwriter.

Instead of good prequalification, a good preapproval is decided regarding real Va loan underwriter’s over article on the newest borrower’s paperwork, not just counting on all the info often just talked about towards mobile between your debtor and you can financing manager. Below, we shall talk about the tips to get a great Virtual assistant loan preapproval…not just good Virtual assistant loan Prequalification.

Watch which temporary movies to possess an easy explanation of the change between a good Va Financing Pre-Recognition compared to. a beneficial Va Mortgage Pre-Qualification:

Va Mortgage Prequalification

Whenever an experienced becomes pre-entitled to an effective Va mortgage, they have been provided by a price of loan size they would manage to reach. Such rates are offered centered on basic pointers the fresh new Veteran provides, will of an extremely short term dialogue with that loan officer. Which discussion and cannot call for a credit assessment. A very clear confirmation of credit reputation and you may fico scores are constantly recommended, especially for Bodies loans particularly a great Va financing.

Think of an excellent Virtual assistant financing prequalification because the earliest restricted step which possibly could happen before genuine Va loan preapproval in the the fresh homebuying process. You can just get an over-all sense of the to purchase energy upcoming begin in search of a property. But taking the even more measures are usually needed seriously to establish an effective reference to a professional bank who’ll then procedure a strong letter appearing their qualifications because the an effective Va client.

When you’re inquiring ways to get preapproved for an effective Virtual assistant house mortgage, we shall deliver the six quick & simple steps right here:

Pre-Approval compared to Pre-Qualification: Very important Technical Differences!

Although many community participants and you may individuals use the terms pre-approval and you may pre-qualification interchangeably, you will find some important variations to remember.

A beneficial Virtual assistant financing Prequalification typically is done by the financing officer, and this passion may or may not tend to be a credit check a massive function into the recognition processes. Loans to earnings percentages is computed with this activity, but count on can not be placed on a leading loans ratio situation without needing the criteria from Automatic Underwriting.

There isn’t any substitute for this. A personnel in the lender need to get a good tri-mix credit file in addition to resulting credit scores from each one of the 3 credit agencies. Unfortunately, new AUS otherwise Automated Underwriting System is going to be manage of the any staff member at the bank, nevertheless integrity and you may authenticity of the Automated Underwriting Data abilities must be verified because of the a good Virtual assistant Underwriter. The new AUS software mostly put is known as Desktop Underwriter.

A good amount of errors can be made in this procedure of the amateur professionals, however, men and women fatal problems could be exposed of the underwriter That’s what They are doing! And in case this new mistake its try deadly, the mortgage could well be refused. When you find yourself within the escrow to find, this isn’t a lot of fun to ascertain that you don’t meet the requirements!

An extremely higher most the newest Virtual assistant mortgage Preapproval email address details are delivered to consumers by loan officers making use of the AUS application by themselves, most as opposed to oversight. A new user on the product is also can perform the software program within era and start to become a bit proficient in just weeks.

A word of Alerting…due to the fact an enthusiastic unknowing Virtual assistant borrower, you would not determine if that it member has integrated fatal problems. You can now type in the details to the software! Most of the borrows aren’t the same. One civil paystub will likely be simple, and some is actually notoriously tricky, just as are a couple of mind-employed taxation statements. For this reason, problems towards the income, debt rations, continual income criteria plus could easily be a portion of the preapproval.

This is a classic trash inside the, rubbish away condition, where the outcome is simply as good as the feel of the software agent. In the event the an inexperienced financing officer helps make an error and you may produces a great Va loan preapproval letter to you personally, it might not feel legitimate, best you off an unfortunate road, lead to own problems.

Pre-Recognition against. Pre-Certification Graph

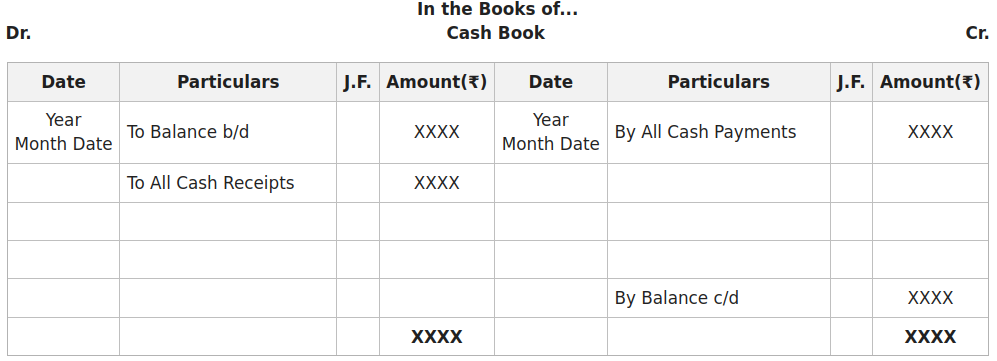

The following chart usually break apart the difference between pre-degree and you may pre-approval while you are answering certain frequently asked questions concerning the Virtual assistant home loan process:

During the SoCal Va Belongings, we’re invested in help you through the Virtual assistant mortgage prequalification processes as much as a beneficial TBD pre-recognition, when necessary. I exceed to help you get safely accredited and you may and make your own offers glamorous! I make the process much easier and submit better results with the help of our unique and you will strong apps.

Virtual assistant Financial Prequalification Calculator

We have many different calculators to help the preapproval having good Virtual assistant financial. Our very own Va home loan calculator makes it possible to guess money. And you may the other calculator may serve as a great Va financial prequalification calculator, whilst reduces your profit and you may explains the debt percentages.

Ensure you get your Virtual assistant Home loan Preapproval Today!

Sr. Va Mortgage Professionals is right here to help you serve you, including Peter Van Brady who authored the significant book on Virtual assistant loans: To avoid Errors & Crushing Your Selling With your Va Financing.

No Comment