Present Alter to help you Domestic Equity Tax Rules

Income tax Deductibility away from HELOC Attention

Eg Household Equity Loans, new tax deductibility out of HELOC attract are dependent on the idea of financing. This is what you have to know:

- Certified House: To help you be eligible for attract deduction, the house equity line of credit need to be covered because of the an effective certified domestic. That it essentially includes most of your family and a second household, should they meet particular conditions.

- Mortgage Objective: As with fixed money, HELOC notice are allowable if for example the funds are accustomed to buy, create, otherwise substantially boost the latest accredited household. Yet not, in case your loans can be used for other motives, the attention may not be deductible.

- Shared Limit: The eye deduction restriction to have HELOCs, whenever combined with the financial financial obligation, is the same as to possess equity financing-doing $100,000 for individuals and up to help you $fifty,000 to own married couples filing individually.

It is essential to look out for present income tax rules transform and how they affect the deductibility out-of Home Security Funds and you can HELOCs:

- TCJA Changes: The new Tax Cuts and you can Efforts Work (TCJA) introduced within the 2017 brought significant transform into deductibility out-of household guarantee attract. Under the TCJA, certain people could find it quicker great for subtract attract for the this type of finance, especially if the loans are used for low-licensed purposes. This new Tax Slices and you can Work Operate (TCJA) from 2017 smaller the maximum amount of income tax-deductible notice. In the event that finalized escrow towards the good HELOC or family security loan before , you can deduct notice into the up to $one million from personal debt if the filing together and up in order to $five hundred,000 regarding personal debt if processing on their own. While the TCJA went toward effect, mutual filers exactly who borrowed after that date can also be deduct appeal on the as much as $750,000 off personal debt, and you may married people which file on their own normally deduct house guarantee financing notice on the around $375,000 out of financial obligation.

- Future Alter: Income tax laws can be develop over the years. Its important to sit advised on the any potential changes in taxation regulations which can affect the deductibility out-of Family Guarantee Loan and HELOC interest in the near future.

Session that have Income tax Pros to the Domestic Security Loan Deductibility

Given the complexities and you will changes in tax laws and regulations, it’s recommended for home owners to go to tax benefits otherwise financial advisers to know the particular tax implications of House Guarantee Loan or HELOC focus. Income tax experts will help dictate eligibility to possess notice deductions, promote suggestions for proper documents, and ensure Irs conformity on the latest tax guidelines toward family security income tax deductibility.

House Equity Funds and HELOCs provide residents which have valuable financial autonomy to get to various desires. Although not, the new tax deductibility of attention reduced on these fund is based towards the multiple facts, like the reason for new credit while the full mortgage personal debt. It’s crucial for home owners to understand these tax ramifications and get informed from the changes in taxation laws that may apply at brand new deductibility out of Domestic Guarantee Mortgage and you will HELOC focus.

Just like the income tax guidelines shall be in depth and you may susceptible to changes, seeking guidance off certified taxation positives is the better method to ensuring direct taxation reporting and optimizing your financial situation when using family collateral credit choice.

Most other Advantages of Household Guarantee Loans

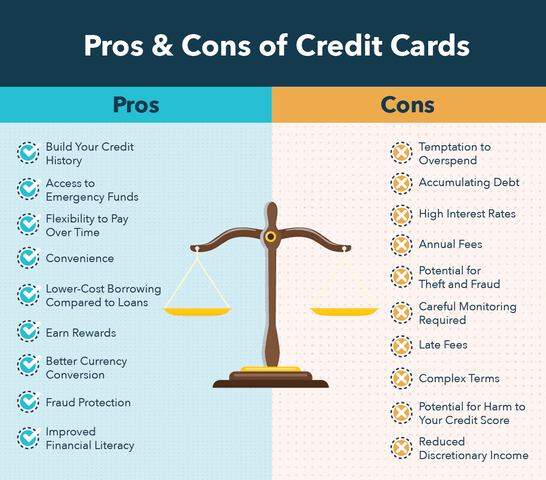

A security financing enjoys other pros besides are tax deductible focus. Listed below are some quite preferred most other grounds that people get home security payday loans Eldorado Springs money:

Low interest rate for the household guarantee financing: If you have one playing cards, you realize you to definitely credit cards enjoys rate of interest of up to 25% in some cases. This will make one large sales on the playing cards end up being very costly if you don’t pay them regarding easily. Your home security mortgage is shielded by your household, and thus your dump our home if you do not spend. Very, the bank might possibly give you money at a significantly straight down speed. Have a look at the current household collateral credit line prices. Keep in mind you to interest rates transform daily also toward domestic collateral finance and you may personal lines of credit and you also must very first meet the requirements which have an effective subscribed HELOC lender. Look at the new home guarantee mortgage criteria.

No Comment