Taxation Deductions into Domestic Collateral Fund and you can HELOCs

Taxation Write-offs to your Family Guarantee Money and you may HELOCs

- Acquisition personal debt vs. domestic collateral obligations: What is the variation?

- Attract toward family equity debt is no longer tax-deductible

- Limits to your tax-allowable buy obligations

Income tax Deductions to your Local rental Properties

Do you have a house equity financing otherwise domestic equity line from credit (HELOC)? Residents have a tendency to faucet their residence guarantee for some quick cash, due to their property while the equity. But before doing this, you should know exactly how which obligations might be handled become tax season.

For the Income tax Incisions and you will Jobs Operate, the rules out-of household equity debt altered drastically. This is what you have to know throughout the domestic guarantee financing taxation once you document this year.

Purchase obligations compared to. domestic equity obligations: What is the huge difference?

Order personal debt is actually financing buying, create, or increase a primary otherwise 2nd household, which will be protected from the home, says Amy Jucoski, a certified financial coordinator and national considered movie director from the Abbot Downing.

That keywords get, generate, or improve is key. Most new mortgages try buy personal debt, while the you will be utilizing banks in Arkansas that offers personal loans online the currency purchasing property. However, money accustomed create or renovate your home is along with noticed acquisition debt, as it will most likely improve the value of your home.

Such as, for people who lent against your home to cover college, a wedding, trips, budding team, otherwise other things, then that matters since domestic guarantee personal debt.

Which distinction is very important to get straight, particularly as you might have a property equity loan otherwise HELOC that’s not experienced household guarantee obligations, no less than about vision of Irs.

In the event your family security loan otherwise HELOC is employed to visit snorkeling within the Cancun otherwise unlock a museum, then that’s home guarantee loans. But not, when you’re with your family security financing otherwise HELOC to overhaul your kitchen or incorporate an one half-bath to your residence, then it is acquisition personal debt.

And also as away from today, Uncle sam was much kinder so you’re able to buy personal debt than family equity obligations utilized for low-property-related pursuits.

Appeal toward house collateral obligations no longer is tax-allowable

According to the old taxation guidelines, you might subtract the attention towards the up to $100,000 of family equity loans, provided your overall financial financial obligation are below $one million. Nevertheless now, it is a complete other community.

Household security loans attention is no longer allowable, states William L. Hughes, an official social accountant when you look at the Stuart, Florida. Even although you got from loan till the the tax costs enacted, you might no more deduct one amount of desire on the family equity debt.

The new taxation rule applies to all of the house security expense, along with dollars-out refinancing. That is where you change your chief mortgage having a whole new one, however, take-out some of the currency once the cash.

Such as for example, state you first borrowed $3 hundred,000 to find a home, after that over the course of big date paid it down to $two hundred,000. Then you definitely want to refinance the loan to have $250,000 and take that most $fifty,000 to assist your son or daughter purchase graduate school. One $fifty,000 your got out over spend tuition are domestic guarantee financial obligation-which setting the interest inside it isnt taxation-allowable.

Constraints to the tax-deductible order financial obligation

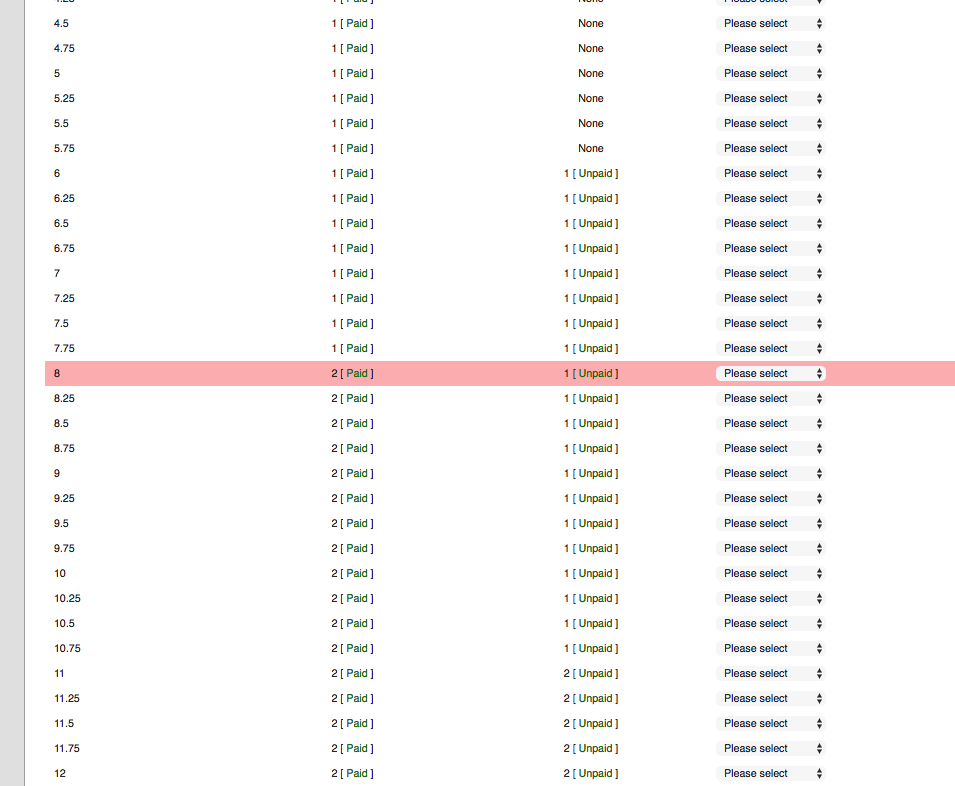

Meanwhile, purchase obligations which is familiar with buy, create, or increase a house stays deductible, however, just around a limit. Any the mortgage taken out of , onward-if or not a mortgage, domestic guarantee loan, HELOC, otherwise bucks-aside refinance-are subject to the brand new lower $750,000 limitation to possess subtracting home loan attention.

Thus, though their best mission is to purchase, make, or boost a house, there are limitations to how much cash the latest Irs often slope from inside the.

No Comment