Ideas on how to Loans Your home When you Currently Very own House

Construction finance will likely be planned in certain means, dependent on if or not you also need to buy belongings otherwise already very own a lot. For those who already very own home and wish to build on it, you might loans your house in several ways. Every bank differs, it is therefore usually a good suggestion to talk about your options which have individuals organization to obtain the solution that actually works most effective for you.

Financing Using a lender

Whenever exploring new house financing that have a financial, start by the only(s) that you have relationships. The greater a bank knows your financial history, the more likely he or she is to work with you. Yet not, never assume all banking companies promote framework funds, anytime your own personal cannot, you’ll have to look at other options in your community.

Usually, you’ll have to make a downpayment out of 20-30% of your own total loan amount. Although not, for individuals who very own the newest belongings outright, you may possibly have the possibility for action just like the collateral. This might be a option if you are looking to save your self cash and you will would rather to not carry out a serious advance payment.

Money Courtesy a builder

Specific builders keeps established relationships with lenders or are creating their individual lending enterprises to really make it easier for customers to locate a construction loan. Occasionally, these businesses render competitive charges and you can costs, very even although you have the choice to help you secure that loan which have a bank, its wise to consult your creator before you alongside see what they give you. A builder can also be able to bring several choice, whereas a financial commonly simply also provides one highway.

One of the benefits regarding financing by way of a builder is the fact it’s not necessary to function as middleman involving the bank and the creator. While they possess a preexisting relationship, they’re going to display the details of the house order, assessment, and you will final approvals. New agents giving creator capital also have usage of programs you to definitely banking companies or any other providers do not, so be sure to discuss all possibilities.

Ready your Profit

Despite hence station you are taking, people financial need to find a record of debt background. You could make the process go better from the getting ready the new pursuing the records in advance:

- A career and you will earnings history

- Brand new action and you will term into the homes to prove ownership

- Tax returns

- W-dos variations

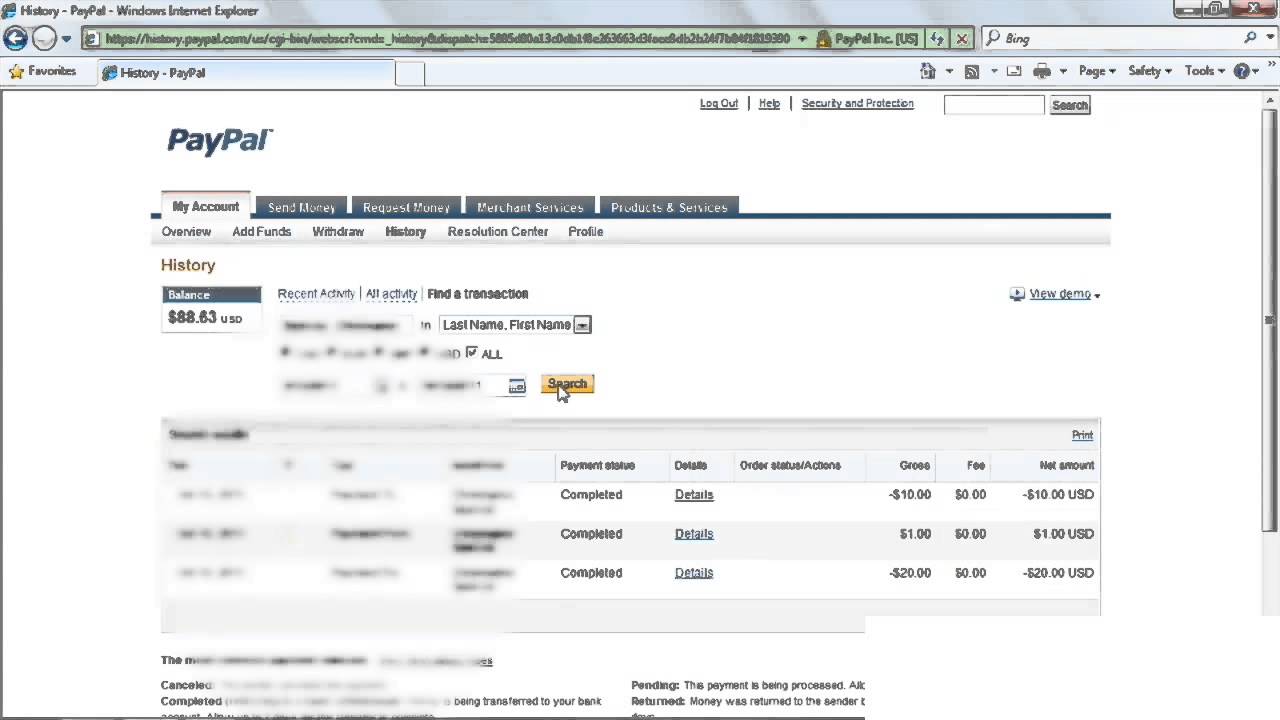

- Financial comments

- Possessions assessment

Really loan providers look for at least 36 months of data, therefore initiate indeed there and get willing to add more as expected.

See the Time

Design money generally speaking feature a time maximum ahead of he is changed into a vintage permanent funding provider. This really is built to allow you enough time to generate in place of that have home financing commission. It is very important know the framework financing name (if this starts just in case it finishes) and this the amount of time figure is sensible. Such, when you get a lender construction mortgage to have half a year and you may the home isn’t really done at the conclusion of people six months, you will have to begin making dominating costs, even though you haven’t yet went during the. This can introduce an earnings problem for the majority homes, so make sure you understand the ramifications of your own financing contract before signing.

For those who individual belongings and therefore are considering the fresh new structure, communicate with a keen Adair Homes representative towards possibilities so you’re able to finance your property. I authored Alliance Financial Features only for taking funding getting Adair Home people. Alliance even offers an payday loans Log Lane Village entire collection off financial services, along with permanent investment, assuming you determine to refinance later on, you already have a reliable spouse. E mail us right now to learn more.

No Comment