Things Should become aware of discover a personal bank loan inside the Mumbai

Are you gonna be choosing a personal bank loan from inside the Mumbai? In this case, then you’re within just the right place. A personal loan is perfect for bridging any monetary gap due to the versatile payment selection and you may small disbursement. But not, checking out the procedure of obtaining an unsecured loan can appear overwhelming by the certain sale and you can different conditions offered.

If you might need funds to possess a dream excursion abroad, scientific exigency, or even for combining debt, being conscious of the important procedures tends to make the process simpler. Discussed here you will find the best considerations you must know about providing a personal loan when you look at the Mumbai.

1) Opinion Their Credit record and you can Rating

Your credit score plays an immensely important character on your financing recognition. Loan providers apply it to evaluate the dependability. When you yourself have a top rating away from 750 and you may over, you are more likely to get financing having appropriate terminology. not, unsecured loans to possess CIBIL defaulters inside the Mumbai are also available, even when they could include a higher level of great interest and you can handling fees.

Therefore, before you apply to have a good Mumbai personal bank loan, always make sure your credit score from the fetching your credit score. In case it is lowest, ensure to alter they before applying. If you’re unable to waiting to evolve your own get and want immediate fund payday loans Lordship access, then choose the best suited contract available for individuals with an effective lower rating however, be equipped for smaller favorable terms and conditions.

2) Contrast Interest rates

Rates of interest can vary significantly in line with the contract being offered. It is very important examine the fresh new costs provided. This should help you decide the lowest priced price. Have fun with an internet personal bank loan EMI calculator to learn the Equated Month-to-month Instalment (EMI) duty based on collection of prices and you can fees tenures. This on line tool can help you make better decisions and steer clear of overburdening your money.

3) Understand the Loan Terminology

Before applying to possess a simple consumer loan, traveling financing, or any other type of personal bank loan from inside the Mumbai, be sure to see the conditions and terms. Go through the cost period, control fees, prepayment charge, and other associated costs. Such as, IndusInd Lender Immediate Consumer loan has the benefit of attractive conditions. These terms produces your loan handling and you will thought simpler. Crucial has actually provided were:

4) App Procedure

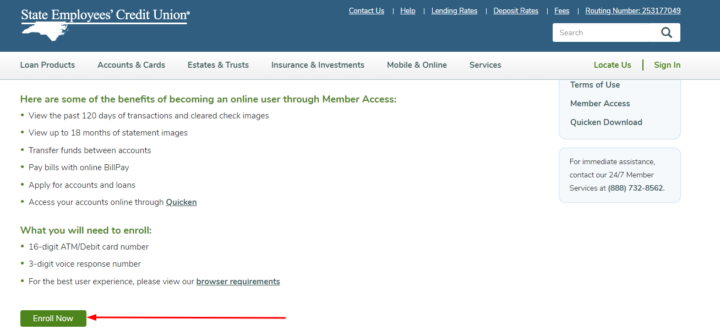

The program process of a personal loan is much easier, thanks to the advances into the digitalisation. This is how you can purchase a keen IndusInd Bank Immediate Personal loan

- Enter in Your details

- Visit the IndusInd Bank website and appearance on the personal bank loan page. On the page, type in your Dish and you can mobile number. To own reduced control, make sure you keep the earnings details, address and Aadhaar handy.

- Top Bring for you

- With respect to the facts considering, IndusInd Bank will bring a knowledgeable offer to you personally. You will see and choose choices tailored towards the requires which have line of rates and you may cost tenures.

- Over Application

- When you find the provide based your decision, complete the software processes. This involves finishing brand new films KYC processes and you may establishing a keen automated installment studio.

- Located Loans

- To the app verification and you will approval, the new continues could well be disbursed for your requirements. After the financing are paid, you could start utilizing it instantly for your financial standards.

Conclude Note

Choosing a personal loan inside the Mumbai pertains to wisdom their credit ranking and you can get, comparing rates, comprehending mortgage terms and conditions, and you will pursuing the software techniques. IndusInd Bank Instant Unsecured loan also provides good 100% paperless and you will seamless strategy to make it easier to get the funds you you want quickly and efficiently. Also, it permits one take advantage of competitive rates and flexible repayment tenures.

Disclaimer: What provided in this post is actually universal and for informational objectives just. This isn’t an alternative choice to particular guidance on the items. And that, you are advised to talk your financial advisor before making any monetary choice. IndusInd Lender Restricted (IBL) will not dictate the brand new viewpoints of your author in any way. IBL and also the creator shall not accountable for one lead/indirect losings or responsibility sustained by the reader in making any economic decisions according to research by the articles and you can recommendations.

No Comment