Try a home security personal line of credit right for you?

That have interest levels lower, you may think for instance the right time to try to get an excellent HELOC. Before you can would, check out things to consider.

Was a beneficial HELOC Most effective for you?

To have people, a good HELOC, otherwise Domestic Security Line of credit, can appear like an easy supply of most installment loans online in Rhode Island fund to simply help security expenditures. You might use HELOC finance to help upgrade your property, purchase college, or pay back large-interest debt.

There are a lot of glamorous areas of a beneficial HELOC. It functions for example a beneficial rotating credit line, settlement costs is limited, therefore pay just notice for the count you actually use over the longevity of the mortgage.

Still, you will find stuff you ought to know exactly how HELOCs performs, plus the means of by using the mortgage, before applying.

What’s a HELOC?

A beneficial HELOC is sort of exactly like a credit card. You may be acknowledged for a borrowing limit according to specific circumstances. You might purchase as much otherwise as low as you want, as long as you usually do not talk about one to restrict. In lieu of playing cards, even though, the quantity you could acquire will be based upon how much guarantee you really have of your property.

- You can withdraw only what you need to purchase expenditures, and you will just when it’s needed.

- You’ll save money, since the you may be merely charged desire on which you withdraw.

- You have the accessibility to and make notice-just repayments. Yet not, using over minimal due each month could save you on the interest in the future.

How can HELOCs functions?

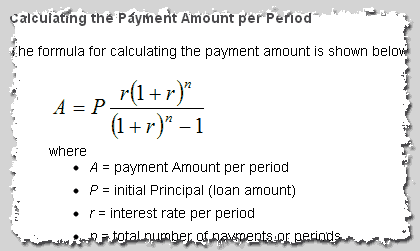

Due to the fact a beneficial HELOC is dependent on the degree of guarantee you have built up of your house, financial institutions fundamentally have fun with a formula that’s predicated on a percentage out of your residence security minus your mortgage.

Including, imagine if you have got $five hundred,000 into the collateral, plus newest home loan was $3 hundred,000. And if you happen to be approved to help you acquire around 80% of the guarantee, then your restriction amount borrowed would be $100,000. The fresh new algorithm works out this: (500,000 x .80) three hundred,000 = 100,000.

Thereupon $100,000, you might borrow normally or as low as you need, doing the maximum. The following is where in actuality the autonomy and you can attractiveness of an excellent HELOC will come in playing. For those who never ever actually have fun with more, say, $20,000 of the personal line of credit, you will only spend desire thereon number.

Points to consider before you apply

Low interest rates and also the autonomy off a great HELOC tends to make them seem like a nice-looking choice at this time. However, you will find constantly facts to consider one which just borrow.

Because HELOCs are a protected personal line of credit, the interest charged on what you borrow is generally below an unsecured line of credit (such as credit cards). Contemplate, even though, it’s your household that is securing the borrowed funds. So, for many who standard, the financial you may foreclose on the household.

For this reason , it’s important to contemplate how you bundle to make use of the money, plus prior spending activities. If you aren’t staying with a sound funds, has a track record of getting irresponsible which have borrowing, or are presently unable to pay obligations, good HELOC might not be a smart financial decision.

Also remember you to when you are interest levels is low correct today, they are attending go up within the longevity of the HELOC. So, it’s also advisable to plan for probably large repayments.

We’re here to aid

There are many reasons as to the reasons a good HELOC may seem eg a eg attractive solution today: low interest, withdraw just what you need, pay focus simply about what your obtain.

However, a good HELOC can high-risk. Rates you are going to go up across the lifetime of your loan. Below average using and credit behaviors might provide in to issues. And you will given this is your house that is securing brand new line of credit, obtaining a HELOC is a thing we should guarantee that suits you.

For individuals who still have issues or issues, we’re usually right here to help. Consult with our Home loan Officials, or listed below are some a number of our online economic degree info.

No Comment