Exactly how is the mortgage processes adopting electronic innovation?

Alternatively, a practical choice is a simultaneous settlement, and therefore not, is hard to find best. Thus, individuals that have bad credit would need to promote earliest and purchase later.

Financial Models

Should you get an expert plan, fixed price financing, earliest mortgage, 100% counterbalance loan, equity financing, credit line or low doctor mortgage? Contrast and save your self!

100% Counterbalance Account

100% counterbalance account allow you to use your casual financing to attenuate the bill of your own financing. This can considerably lower your attract, helping you save plenty!

Basic Financial

Will you be just after a simple home loan to the cheapest notice rates with no constant costs? Discover which financial is the best for your situation!

Collateral Funds

Trying refinance, upgrade, invest into the a house otherwise pick a special home? Find out which financial will bring you that loan acceptance with the cheapest costs!

Repaired Rate Mortgage

Prices rise and you can slide, but you can lessen the risk if you take out a fixed rate financing. Find out which financial will save you out-of highest interest rates.

Home loan Features

Redraw, 100% offset, most costs, percentage holidays, portability & breaking. Cut through the brand new confusion with our effortless help guide to make it easier to like your provides

Mortgage Redraw

A mortgage redraw business enables you to access any extra repayments you have made on the mortgage. Could it possibly be effectively for you? A whole publication for the redraw.

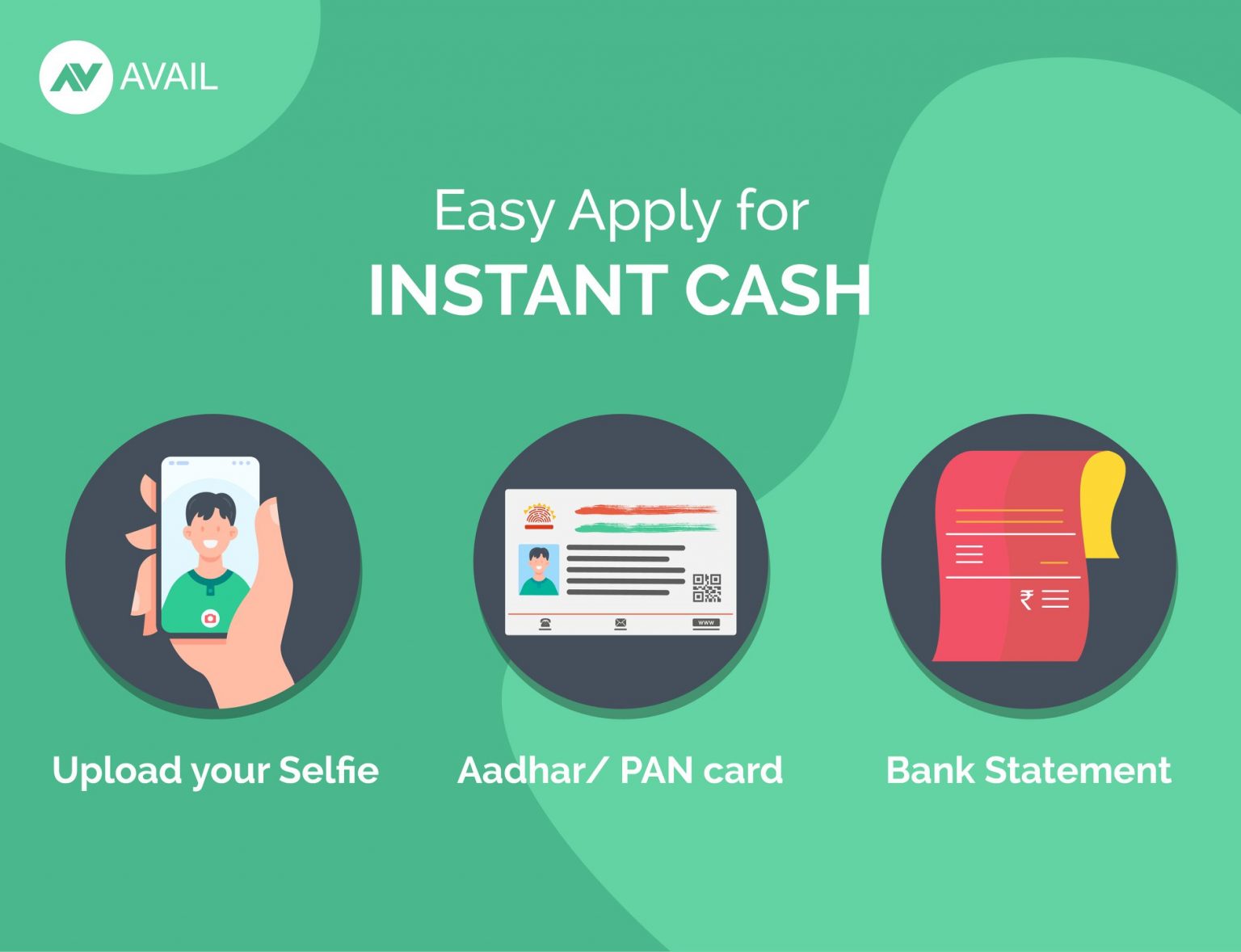

Electronic home loans take the rise now. He’s book has which help you to buy assets otherwise purchase a house right from your residence.

Personal line of credit

Personal line of credit lenders allows you to put your income into the loan and you can draw finance off when needed. Hence financial towards the our very own panel can offer you the best speed?

Personal line of credit Home loans – As to the reasons Finance companies Dislike Him or her

A line of credit mortgage enables you to access certain of existing security you accumulated of your home. not, banks/loan providers hate them! Discover as to the reasons.

Reasonable Doctor Financing

Will you be self-employed and get dilemmas indicating your earnings since you lack payslips otherwise 2 years tax statements as research? We could enable you to get financing, observe how!

Partial Counterbalance Membership

Do you realize you can buy a limited counterbalance account with fixed-price finance? Observe a limited offset feature assists save thousands of dollars in the installment.

Elite group Bundles

Pro Packages bring waived application costs, deals for the rates & almost every other products particularly cheque levels and you can credit cards. And this lender is the least expensive?

Rates Tracker Mortgage

An increase tracker financial is linked right to their appeal rates which moves according to RBA dollars speed. Which are the positives and negatives?

Split Mortgage

Can’t select whether you 5000 loans Weston will want to protected their enhance your attention rate otherwise wade varying? Take advantage of the better of one another worlds that have a torn financial!

Variable Price Home loan

Looking for an adaptable home loan? See how much you might acquire just in case your qualify for a competitive varying rate financial.

Shortly after your property is offered, you just continue steadily to generate typical home loan repayments, as well as the compounded connection loan attract, towards the new loan.

Do you know the positives?

From inside the cases such as these, lenders will probably inquire far more issues and certainly will like to see the facts of one’s the newest possessions and you can proof your most recent house is are definitely ended up selling.

Just what otherwise would you like to thought?

Meanwhile in the event, you’ll want to sign up for in initial deposit thread so you’re able to secure the acquisition of the latest assets.

Sadly, you cannot get a bridging mortgage with poor credit. Really the only difference was consumers having small defaults (not as much as $500) that will meet the requirements toward a situation by situation base.

No Comment