A mortgage is no longer experienced good nontraditional mortgage since the teaser rates possess ended

The knowledge, yet not, have to be since a romantic date that is no prior to when three months before purchase of brand new home-based mortgage

(f) Rescheduling dominant or notice costs to make otherwise improve an effective balloon commission otherwise expand the new court maturity go out of your loan by over six months.

(a) A lso are-ageing, recognized as going back an unpaid, open-end membership so you can newest updates as opposed to event the quantity of prominent, focus, and you will costs that are contractually owed, provided:

(i) New re-aging is part of a program you to definitely, at the very least, adheres to the re also-ageing direction required throughout the interagency recognized Consistent Shopping Credit Category and you may Account Management Plan; a dozen

12 Among other things, for a financial loan become thought having re also-aging, next have to be real: (1) Brand new debtor have to have exhibited a rejuvenated desire and you can power to pay-off the borrowed funds; (2) the borrowed funds should have lived for at least nine days; and (3) the newest debtor need to have made about three consecutive lowest monthly money and/or comparable cumulative number.

(ii) The application form keeps clearly defined rules recommendations and you can variables to possess re-ageing, plus inner ways of making sure this new reasonableness of these guidelines and monitoring their effectiveness; and you can

Refreshed research for domestic financing is defined as the most recent study offered

(iii) The bank checks the count and you may dollars number of re also-old membership, collects and analyzes investigation to assess the fresh abilities regarding re also-old account, and identifies the effect regarding re also-ageing practices into delinquent percentages;

(b) Modifications to financing that would if not fulfill that it definition of refinance, however, improve class out-of that loan while the a beneficial TDR;

(c) People amendment made to an unsecured loan pursuant to a government program, like the House Sensible Amendment System or even the Home Affordable Refinance System;

(e) A great contractual deferral out-of repayments otherwise change in interest one are similar to the regards to the first loan arrangement ( age.grams., since acceptance in a few figuratively speaking);

(g) An advance out-of finance, a rise in new line of credit, or a modification of the speed that is in keeping with the terms of the borrowed funds arrangement to own an unbarred-avoid or rotating credit line ( age.g., handmade cards or house collateral lines of credit);

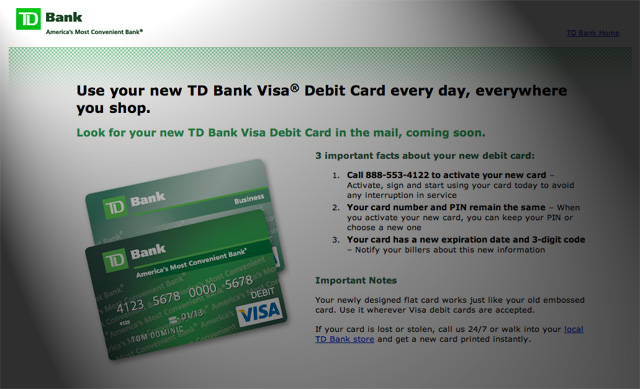

(i) Substitution an existing credit as the new is actually expiring, for security reasons, otherwise because of another technology or another type of system;

(iv) Bringing the means to access extra credit https://paydayloanalabama.com/deatsville/ when a bank provides internally acknowledged increased personal line of credit than just this has given to brand new customer; otherwise

(v) Altering the rate away from a credit card range whenever required by-law (like in the case of the financing Card Operate).

Nontraditional mortgages become every home-based loan items that allow borrower to help you put off payment out of dominant or desire and can include all the interest-merely situations, intro speed mortgage loans, and negative amortizing mortgages, except for home equity personal lines of credit (HELOCs) or contrary mortgage loans. An intro-speed mortgage is defined as home financing with a marked down initially rate where in fact the financial has the benefit of a lesser speed and lower money to possess the main mortgage title. A destination-simply loan has stopped being noticed a great nontraditional mortgage loan once the loan actually starts to amortize.

Banking companies must determine whether domestic finance meet the concept of a great nontraditional home mortgage by origination, otherwise, in case the loan has been refinanced, as of refinance, because refinance is scheduled contained in this Appendix to possess purposes of highest-exposure individual fund. Whenever a bank acquires a residential mortgage, it will determine whether the mortgage suits the definition of a great nontraditional mortgage utilising the origination conditions and you can studies did from the the first bank. If it info is not available, the financial institution need obtain renewed studies in the borrower or other suitable 3rd party. The fresh obtaining financial must also see whether an acquired financing try higher risk maybe not later on than 3 months just after buy.

No Comment