Do you know the Money Limits for Household You’ll be able to?

Family It is possible to are a traditional financing system created by Freddie Mac. Its a more affordable choice because of its smaller step 3% so you can 5% advance payment specifications.

House You can mortgage loans can handle lower so you can moderate earnings house consumers and first-go out homebuyers and you can younger individuals. This method can help you move from merely renting a property so you’re able to purchasing your home.

Which are the Requirements?

Family You’ll be able to mortgages let basic-go out home buyers. It does not limitation customers who happen to be trying to up-date although not, you cannot very own some other residential property in order to approve to possess an effective Family You can easily program. For people who very own a property, you would have to offer your household before you take toward a house You’ll be able to mortgage. You’ll be able, although not, to close off into the the domestic you are promoting together with family you are buying on a single time.

A property You’ll system are used for purchases or refinances. No money-outs are allowed even when regarding an effective re-finance. As with the actual situation whenever changing regarding a thirty-seasons financial so you’re able to good fifteen-seasons one to, refinances can only just be employed to improve your interest or name.

Just before closing the loan, people debtor who are toward financial note, consequently they are first-day home buyers, has to take a good homeownership path label CreditSmart ahead of closing this new financing. A first-time domestic customer was someone who has not yet had any brand of house over the last 3 years. Its a no cost system which are possibly removed on line or in individual. After doing the applying, and that just requires couple of hours, you might print-out a certification.

Earnings limitations to use to that system due to the fact Home It is possible to home loan is designed for reasonable so you’re able to reasonable-earnings borrowers. To help you qualify for the applying, your earnings never meet or exceed the space Average Money (AMI) the spot where the property is discovered.

You will find some conditions on income limitation. For example, in high-pricing elements, instance near huge places. Higher earnings are permitted much more costly portion.

Several other difference is that there isn’t any debtor limitation inside outlying otherwise underserved components. To determine what nearby earnings limits and you may assets qualification is, fool around with Freddie Mac’s money and assets eligibility unit.

All debtor income have to be reported given the money restrictions stipulated. The principles require also a constant month-to-month earnings, or a 2-seasons money history, for everybody of your individuals whom indication the mortgage note.

Very financial software require you to definitely specific section of down-payment started from the borrower. However with Home Possible funds, financing may come off some supplies which means you helps make their step three% so you’re able to 5% down payment requirements. Some of these offer become:

- Money from loved ones and/or nearest and dearest

- Reasonable seconds software

- Staff guidance apps

If nearest and dearest or household members help you with the amount of money for your downpayment, it needs to actually become something special. It cannot getting a temporary financing that you’re likely to pay off. For this reason, your donor should sign home financing provide page. That is a legal document saying that the funds is actually really a present.

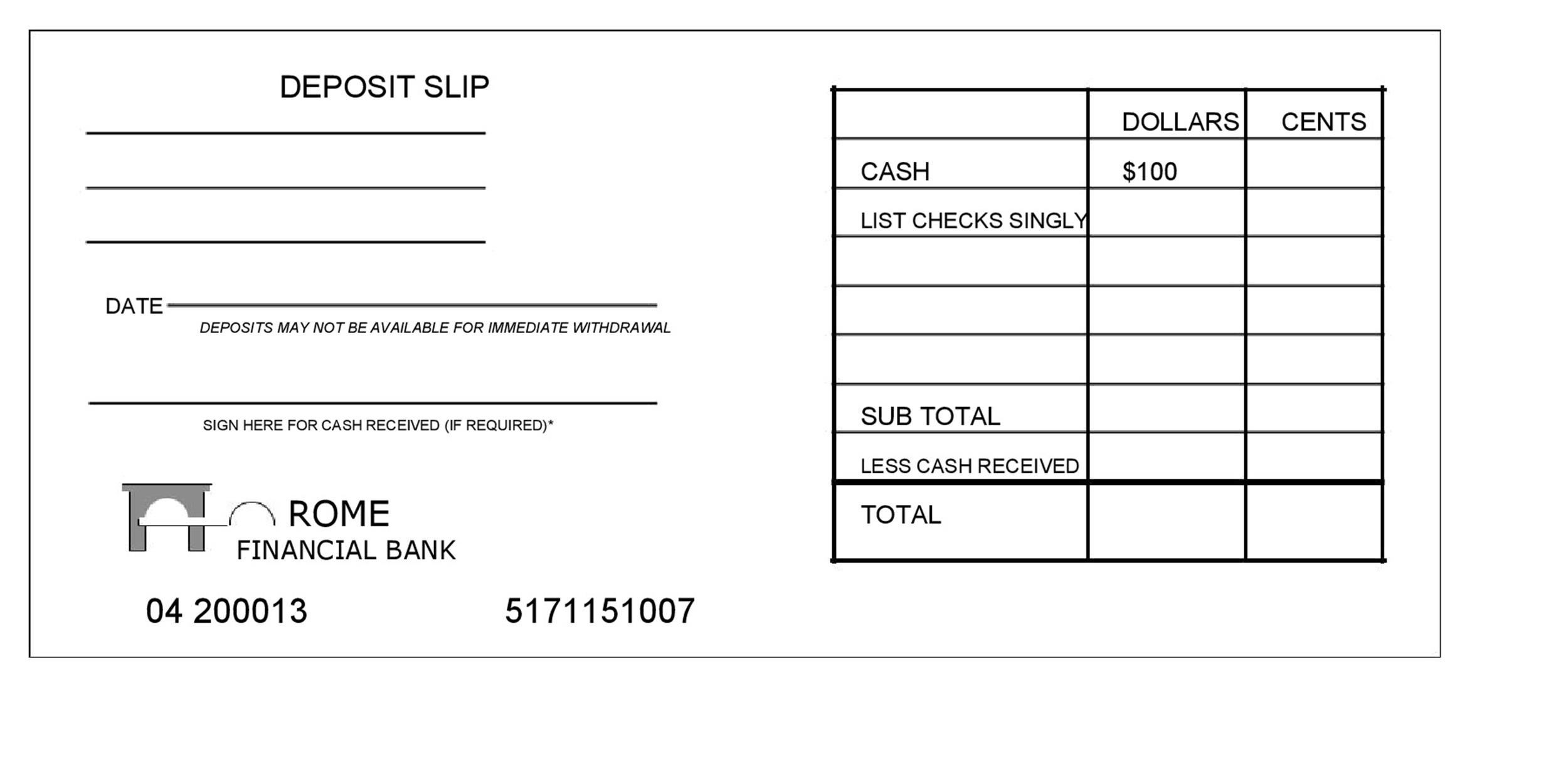

Additionally, you will should make sure you are using knowledgeable loans by taking funds from your coupons, examining otherwise IRA profile. Seasoned fund are currency that was in another of those makes up about a time period of at the least two months.

Finally, make sure whether you are playing with gifted funds or men and women out of your account, the cash is actually traceable. This means that you might not use money your started keeping from inside the an excellent envelope on your own case. Alternatively, the funds need to have a beneficial traceable record from the origin.

More Home Possible Assistance

Any debtor exactly who cues the borrowed funds have to be an occupant out of your house. What’s more, it should be its number 1 quarters, perhaps not a residential property otherwise second family.

You can find $1500 loan with poor credit in Hasty credit history standards as well. Minimal FICO get required for Family You’ll be able to fund are very different because of the financial. Conventional financing generally need a get away from 680 or even more. Although not, minimal credit history having a home You’ll be able to mortgage is generally 620.

No Comment