Best Invoice Software for Small Businesses Wave Financial

These solutions are integrated within your dashboard and you’ll access them both through your single Wave login. Allows an unlimited number of users in the Pro plan, but is not complex enough for businesses with more than a handful of employees; ideal for very small service-based businesses, freelancers or contractors. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

- Only integrates with in-house apps, like Wave Payments and Wave Payroll; does not integrate with card readers for in-person payments.

- Next, you can add sales tax (if necessary), create customer profiles and customize your invoice templates.

- Pro plan capabilities include recurring invoicing and the option to let repeat clients opt into automatic credit card billing.

- I entered my private information on their site including social security number to generate pay stub.

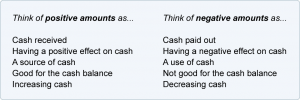

- Accounting software helps business owners understand how money flows in and out of their businesses.

- At any time, you can activate to start your billing cycle and gain access to items like tax filing and approving payrolls beyond the current month.

Easy payroll software for small business

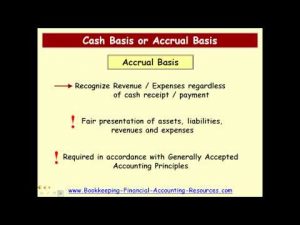

For example, QuickBooks Online doesn’t have a free plan, but offers four paid plans, each with additional features, making it a great choice for scalability. With the higher-tier QuickBooks plans, you have access to inventory management, billable expenses and project profitability tools, none of which are offered with Wave. Know when an invoice is nonaccrual experience method nae viewed, becomes due, or gets paid, so you can take the right actions to manage your cash flow. Set up invoice reminders to automatically email your customers when payment is due. Allow your customers to pay your invoices immediately via credit card, secure bank payment (ACH/EFT), or Apple Pay. You’ll both appreciate the speed and convenience.

We believe small businesses arethe heart of our communities.

Upon processing your first payroll, you can use Wave Payroll for up to 30 days, commitment-free. At any time, you can activate to start your billing cycle and gain access to items like tax filing and approving payrolls beyond the current month. See our full US terms here, and our full Canadian terms here. These 14 states include tax services with the option to automatically transfer tax payments and file the paperwork with your state tax office and the IRS (this excludes 1099 Filings). NerdWallet’s accounting software ratings favor products that are easy to use, reasonably priced, have a robust feature set and can grow with your business.

Unlimited billable customers at no additional cost

Pro plan capabilities include recurring invoicing and the option to let repeat clients opt into automatic credit card billing. Electronic invoices are created with online invoicing software or other cloud-based services, which makes it easy to automate the invoicing process. Electronic invoices also provide small business owners with professional-looking digital invoices that their customers can pay easily online through a system like Wave’s online payments.

Benefits of Wave Accounting

It offers both phone and email support, too. In addition to its accounting software, Wave offers paid services, including Wave Payments, Wave Payroll and Wave Advisors for bookkeeping support and accounting coaching. Wave invoices are integrated with our free accounting software, so payments are recorded and categorized for you – which means less bookkeeping and tax season prep.

The financial management software is user-friendly and equipped with all the basics, including income and expense tracking, invoicing and reporting. You can mark invoices paid on the spot, so your records are instantly up to date. Accept payments through credit cards and bank payments to get paid even faster, for a low, pay-per-use fee.

Zoho Books offers a robust free plan, along with a range of paid plans that feature workflow automation. QuickBooks Online’s detailed reporting and transaction tracking is ideal for growing businesses. Moreover, you can integrate QuickBooks with hundreds of third-party tools available in the freight expense app marketplace. There are also add-on Intuit services like QuickBooks Payroll or QuickBooks Time. Includes tools that help automate the reconciliation process and auto-categorizes transactions for you in the Pro plan, but you can’t set up your own bank rules; no global search function.

Create and send professional invoices to your customers in seconds. Have an eye on the big picture so you can make better business decisions. Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you cost of long term care by state can easily identify cash flow trends. Sandra Wrycraft is the Chief People Officer, focusing on fostering a high-performance culture driven by a commercial mindset and a customer-centric approach. Sandra comes to Wave following a decade of management consulting.

When you reconcile your books, you’ll navigate to the “Reconciliation” tab within the Accounting menu. If you need to manually edit, add or remove any transactions, you can do so on the Reconciliation or Transactions pages. Next, you can add sales tax (if necessary), create customer profiles and customize your invoice templates. You can sign up for Wave quickly and easily online.

My bad..partly because S Corp book keeping and payroll is new for me. I was hoping that the upgraded services could help with my moving from a sole proprietor to an LLC. The really unfortunate thing is the book keeping assigned to me didn’t call me and ask any questions. She did the work with a “cookie cutter” approach, wiping out several months of my previous entries. The free service is fine, but beyond that, look elsewhere.

After providing a few basic details about your business — name, type, currency you use, address — you’ll have instant access to your account. Can manage multiple businesses for free under one account; lacks project tracking tools, industry-specific reports and transaction tracking tags. 2 Rates are 1% for bank payments (minimum fee of $1).

He comes to Wave with decades of executive experience, most recently as General Manager for Afterpay North America, and previously as Executive Vice President at Mastercard. He joined Mastercard in 2012 as Chief Executive Officer for Mobile Payment Solutions (MPS) where he was responsible for deploying mobile solutions in Brazil, Argentina, Egypt, Indonesia, Philippines, India and Turkey. Companies can ask for reviews via automatic invitations. Labeled Verified, they’re about genuine experiences.Learn more about other kinds of reviews. People who write reviews have ownership to edit or delete them at any time, and they’ll be displayed as long as an account is active.

It’s hard to beat free accounting software, especially if you’re running a small business on a budget. Wave’s free plan offers a decent number of features, like unlimited invoices, that are not always included with other free accounting software options, let alone paid accounting software plans. It also complies with accounting standards and uses double-entry accounting, which can help ensure accuracy. With Wave’s web-based invoicing software, you can create and send invoices for your business in just a few clicks from your computer. All you need is an Internet connection and a browser!

Lastly, my connection to BofA kept failing. “If you receive the error, “Couldn’t connect to your institution,” it’s because there’s a known issue between our third-party data aggregator and your bank.”How is this even a thing in 2021? You are partnered with RBC and you are blaming your inability to connect customers to their banking on a third party app lol.Hire a better product team. Our payroll software is seamlessly connected with the rest of your Wave account to reduce the time you spend on manual bookkeeping. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. The rate that you charge for your freelancing services can vary, so it’s important to get a grasp of market trends before sending your clients an invoice or quoting a price.

Servers are housed under physical and electronic protection. Wave is PCI Level-1 certified for handling credit card and bank account information. Connect your bank accounts in seconds with the Pro Plan. Transactions will appear in your bookkeeping automatically, and you’ll say goodbye to manual receipt entry.

Wave is a Canadian company with no real legal recourse within the United States, Please do not do business with this company if you are a small or medium size business. We offer to do business with them and they process our customers money and then decide to reverse the transactions, telling us they could not find our company. We are in business since 1999 This company is a get rich quick scheme. These small company has great ideas but horrible leadership.

This makes Wave unable to handle taxes in countries like Australia where prices must be quoted inclusive of all taxes, such as GST. There is no way to set an invoice total and have Wave calculate the tax portion as a percentage. Wave acquired a company called Small Payroll in November 2011,[8] which was later launched as a payroll product called Wave Payroll. In February 2012, Wave officially launched Wave Payroll to the public in Canada,[9] followed by the American release in November of the same year. The developer, Wave Financial Inc, indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy.

This is very disappointing and now trying to find a new free service to send invoices for my small company. Set up recurring invoices and automatic credit card payments for your repeat customers and stop chasing payments. You can effectively analyze the financial health of your business, find ways to generate more profit, and move forward with your business plan. They take the money away from you and the entire thing has been one embarrassing ridiculous mess.

Accounting software helps business owners understand how money flows in and out of their businesses. This can help you save time and make financial decisions quickly. Your customers can pay the invoices you send them instantly by credit card, secure bank payment (ACH/EFT), or Apple Pay. And by enabling Wave’s payments feature, you can accept credit cards and bank payments, and get paid out in as fast as 1-2 business days1. Wave’s invoicing is free and unlimited, with customizable templates and a user-friendly interface, putting it on par with some of the best invoicing software solutions for small businesses.

No Comment