How Resource Circle financing procedure functions

Within Resource Community, we try to struck a balance ranging from comprehensive underwriting and you will quick financing. We strive to keep the company loan application process a flaccid, fast you to definitely to make sure your information is safe and you can safer. The conditions to own a business loan are as follows: I ask for 24 months of team federal tax statements, six months out of team bank statements, your current business financial obligation suggestions, and one season off personal federal tax statements for every private the master of 20% or even more of one’s business. Every piece of information you render helps us know your own company’s total tale and better evaluate how that loan will help your online business expand.

To save all of our organization financing interest rates reasonable, it is essential that we underwrite our funds very carefully and make certain the audience is credit so you can advertisers that will repay the money. The following is more information on that which we usually view and just why:

Financial statements

One of the reasons we demand bank comments due to the fact a business loan requirement is that they give us a real-big date look at your businesses earnings. Suit, consistent birth, and conclude stability usually mean good organizations capability to support mortgage payments, expenses, and extra types of debt.

In case the credit in the team are greater than brand new debits out, it implies that your company is expanding. This is an excellent sign one to a loan can assist maximize your business prospective and you may earnings. I along with look out for warning flag including overdrafts and came back circumstances, mainly because can recommend poor dollars management.

Private credit history

Although we lend just to people, i along with weigh a business customer’s personal credit history within analysis away from a corporate loan application. For those who have an effective personal credit history – which have couple if any later payments, partners borrowing questions, and you can the lowest borrowing use price – it’s an effective signal that you are economically savvy, in charge, and ready to repay that loan in place of things.

Expenses

In the long run, with regards to what you need to score a corporate loan with Capital Circle, we account for your organizations a good loans and your monthly payments in these funds. The purpose of this is doubled: 1) If you find yourself attending make use of your Money Community loan in order to refinance your own costly established debt, it assists me to know what variety of give might need out of us to properly cover your installment and you will 2) Which have a sharper image of your own businesses loans standing helps us learn your position and you may tailor all of our render to keep the really currency.

Due to the fact underwriters, we are right here to make the top and you can fairest choice so you can dictate their creditworthiness. This is what we offer when it comes to our very own company loan requirements and you may our very own techniques:

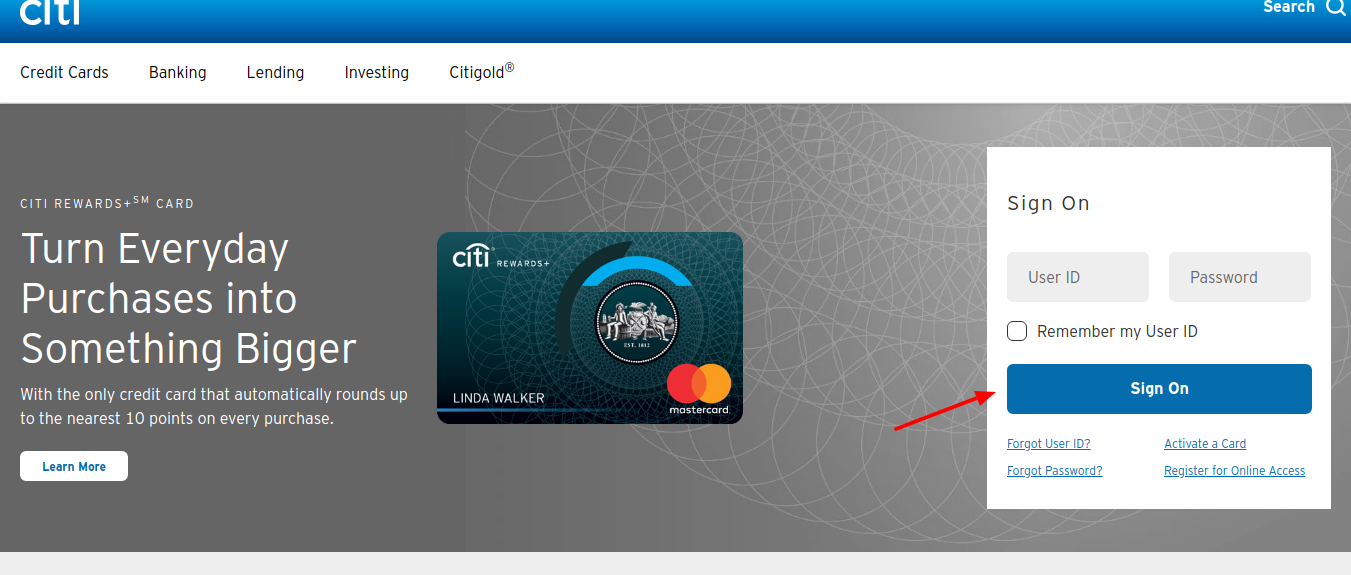

step one. Complete your business loan application on the web

All of our on the web loan application is free, effortless, and you will requires on half dozen minutes. All you have to do was submit a payday loans De Beque number of outlines out of personal data, publish your write-ups, and click complete. The good thing: you could potentially use having zero obligations. Look at the qualification and you will our very own conditions getting a business mortgage right here.

2. Tune in to of you inside an hour or so

No further prepared within the worried expectation. Within an hour of using, you are contacted of the our personal bank loan professionals so you’re able to review your posts, talk about your options, and you will address any queries you have on what need to track down a business loan.

step three. Rating a choice within 24 hours

From that point, all of us from educated underwriters are working to determine the loan qualifications. To make certain you get the best review you’ll, we shall assign just one underwriter towards app. With cutting-edge underwriting technology, your underwriter often feedback your own financials and you may business intends to evaluate your creditworthiness. The underwriter get phone call to get more recommendations away from you along the way, and if what you goes better, you are able to find a business loan decision in the a single day.

No Comment