See just what Our very own Customers Need certainly to Say

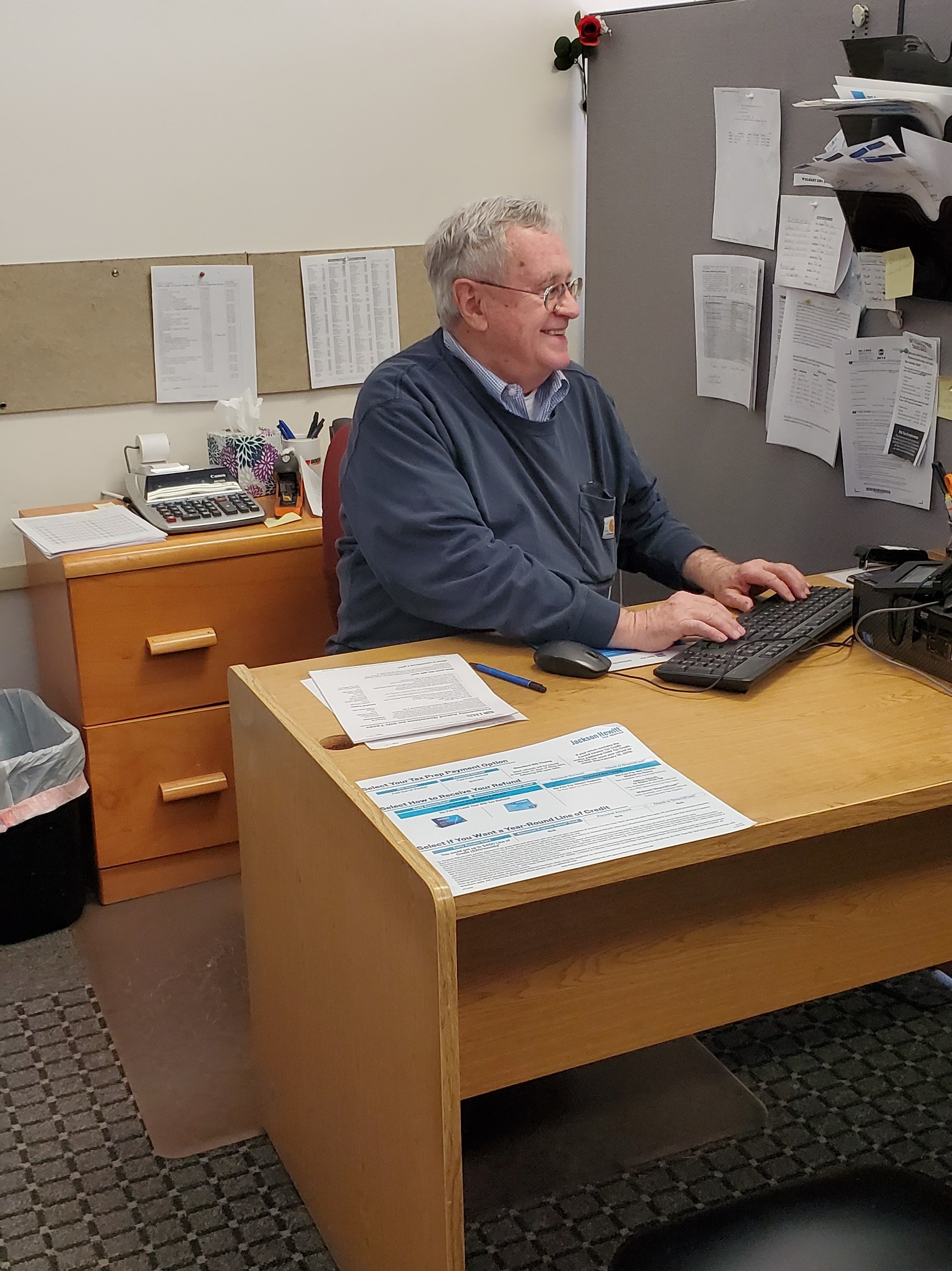

Albert Steele believes throughout the value of home ownership and understands the significance of finding the right mortgage for achievement. Having a-deep comprehension of the many mortgage apps Mutual away from Omaha Financial also offers, Albert really works directly understand for every single customer’s needs, and acquire mortgage remedies for finest fit the economic requires.

123 Reviews

Throughout the borrowing processes you could potentially rely on Albert becoming a trusted book from the mortgage procedure and ensure that the loan is carried out carefully, correctly, as well as on time. Albert Steele is actually backed by a faithful party out-of functional experts and you will condition-of-the-art technical built to result in the loan process basic efficient.

Regardless if you are thinking of buying, refinance, and take out a home security mortgage, Albert Steele might be willing to talk to your regarding the latest need, and your long-variety desires and discover a funds program that really works effectively for you. Get in touch with Albert right now to begin.

See with all your mortgage systems under one roof and you may flow the method forward having a view here.

- Antique Financing

- Refinance/Cash out

- Sleeve Mortgage

- Va Mortgage

- FHA Loan

- USDA Financing

- Jumbo Mortgage

Conventional funds commonly backed by a federal company, including the Government Homes Government, for example conventional money much more versatile in their conditions and you will possess fewer restrictions. Although not, traditional financing often meet the downpayment and earnings conditions put because of the Fannie mae and you will Freddie Mac computer, and you will comply with the mortgage limitations put because of the Federal Property Loans Government. A number of great things about these lenders is, aggressive rates, less charges, an option for 2nd household purchases and flexible requirements to possess financial insurance coverage. During the Common off Omaha Home loan, we offer several loan terms and conditions with repaired or adjustable pricing.

After you re-finance the financial, you have to pay away from your financing with a new mortgage one constantly even offers a far greater rates otherwise a smaller title. Often, refinancing to a different home loan product can offer professionals as well. Refinancing comes with offers along the longevity of the mortgage and may also bring immediate positive points to your existing monetary or personal condition.

A money-out refinance replaces your current financial with a brand new mortgage getting more you owe in your family. The difference would go to you inside bucks, so you can spend they to your household renovations, advancements, debt consolidation and other financial requires. You must have collateral accumulated inside your home when deciding to take advantage of a cash-aside refinance. Antique refinancing, conversely, substitute your existing mortgage with a brand new one for similar harmony.

The kind from a variable-speed home loan lets buyers and those looking to refinance to help you, in ways, have fun with the odds’ towards the future rates of interest. Case loans come connected to a predetermined-speed throughout the a preliminary passing of time. This can cover anything from 5, eight otherwise a decade, based on your specific mortgage requires. Then, the loan interest might possibly be determined of the no matter what heading rates is actually for your loan. Such as for instance: Your secure a supply at 5 years within a beneficial 3.75% interest. Then 5-year period, interest levels on your own loan unit can also be go up, slide otherwise stay an identical. The second try barely the fact unless a giant change into the new national financial image rattles the text business at which interest rates is actually directly tied up.

The brand new Virtual assistant financial program is actually a home loan program supported by the brand new U.S. government that assists services professionals, experts, energetic armed forces and you can eligible enduring partners end up being homeowners. New Virtual assistant home loan lets accredited You provider people and you may experts buying or re-finance a property at competitive rates and you will that have $0 advance payment. In addition, Virtual assistant financial gurus are reduced settlement costs, zero private mortgage insurance (PMI) otherwise charges to possess prepayment. While the Virtual assistant financing is actually a federal system, government entities generally will not create head finance in order to individuals. Private loan providers, along with Shared out-of Omaha Financial, financing the loan due to the fact Veteran’s Government offers an insurance make sure. That it make certain brings a reward to have individual loan providers to provide financing with top words and covers them if there is an effective customer default.

Paid by You.S. Agencies out of Housing and you can Metropolitan Creativity (HUD), FHA loans are bodies-supported home loans given by personal lenders for example Shared away from Omaha Home loan. FHA Finance can be used to financing house to own earliest-date homebuyers, which arrived at Shared away from Omaha that have quick-existed or stressed credit rating and you can shorter downpayment specifications. FHA fund try federally covered, definition the customer cannot deal with steep downpayment or PMI conditions relative to traditional finance. Capital a home loan is much more attractive getting FHA loan-eligible people. Old-fashioned mortgage activities generally wanted ten%-20% upon that loan, with regards to the client’s taste to your PMI. FHA Financing succeed accredited buyers the opportunity to purchase property which have only 3.5% off.

The latest USDA financing program’s mission should be to render affordable homeownership ventures so you can lowest-to-reasonable money house so you’re able to stimulate economic development in outlying and residential district organizations regarding All of us. An excellent USDA financing was a home loan that provides considerable experts for people aspiring to buy a home during the an cashadvancecompass.com how do i get emergency cash from direct express eligible outlying area. USDA lenders was issued because of individual loan providers and tend to be secured of the United states Department away from Farming (USDA).

Jumbo money was chatted about on buyer whenever a client’s full downpayment doesn’t put the overall fund worthy of at the smaller as compared to state mortgage limitation based a residence’s area. The loan maximums are very different by state. An enthusiastic step one,800-square-feet domestic in a single county might possibly be cherished on a high matter than simply some other as a result of the nearby housing market. An element of the practical app processes towards people loan is to make sure credit history, earnings and you can a job recommendations. Jumbo money have more strict requirements just because of the higher-risk nature of the mortgage.

No Comment