You can aquire financing to simply help pay money for the NIU studies

This means a vendor will give you currency, and you’ll repay it that have a specific amount additional. This even more number is called desire, and it also alter considering just who will provide you with the borrowed funds.

Some fund provides a number of repayment choice. Some fund can also be terminated, and that means you won’t need to pay them straight back.

New Federal Student Help (FSA) web site has a lot of facts about funds. We are going to give you a synopsis and you can direct you toward FSA web site for much more details.

Loan providers

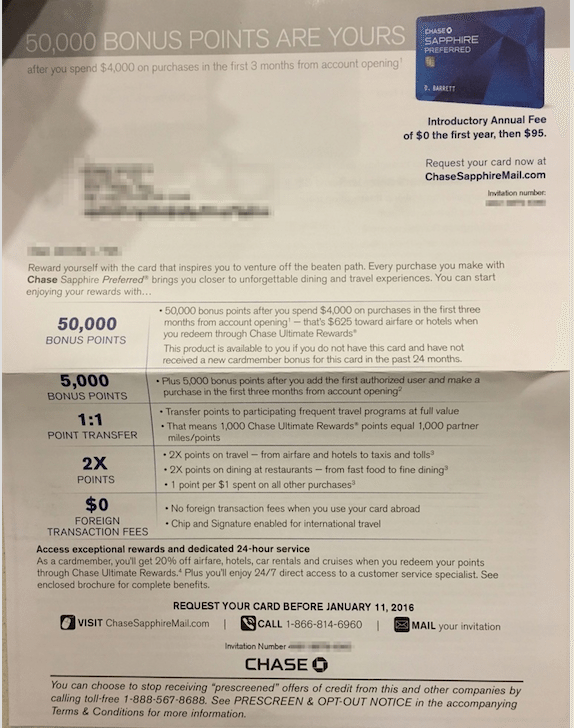

There are numerous loan providers, or lenders. You can aquire a loan regarding federal government otherwise out of an exclusive financial. Federal funds have many payment solutions and will provides all the way down interest costs than simply personal funds.

Money in the Federal government

Government entities also offers Direct Loans to help you children in addition to their parents. You could sign up for Lead Loans by the filling in this new 100 % free software having government student services (FAFSA).

If you take a direct Loan regarding the government, another company will probably be your financing servicer. You’ll be able to send payments toward business, and you may ask them questions you’ve got regarding the loan. For those who take on a direct Loan, you’re informed using your earliest semester from the NIU by the the loan vendor.

Funds out of Personal Loan providers

You can discover financing of a personal bank, for example a financial. We can not let you know and this bank to utilize, thus you will need to perform some research. After you contemplate bringing a private financing, inquire such inquiries:

- What’s the loan’s rate of interest?

- Just what are its installment conditions?

- Am I entitled to so it mortgage?

By firmly taking an exclusive mortgage off a lender such as for instance a great bank, these are typically the loan holder. You can easily publish repayments to them when it is for you personally to begin purchasing back your loan.

If not spend the money for count you owe from the due go out, your loan will be past due, or unpaid. Should your mortgage try delinquent for 90 days, it will damage their credit. For folks who continue steadily to perhaps not make the percentage, the loan might go on the default.

- The complete matter your debt would-be owed instantaneously.

- You may not be capable of geting any further government student help.

- Your credit rating can go down, so it is hard to get finance in the future.

installment loans for bad credit in Oakland IL

If you fail to manage the monthly payment, you will need to work punctual so you dont enter default. Next information is on the government funds. When you have an exclusive mortgage, ask your financial on slowing down or cutting your payment.

Score a great Deferment otherwise Forbearance

You might ask to help you briefly stop and work out repayments on your federal loan. This can be called a deferment or forbearance. You ought to demand a good deferment otherwise forbearance from the financing servicer and you will demonstrate that you meet qualifications standards.

Many reasons exist so you’re able to request a good deferment or forbearance. Like, you will possibly not enjoys a job, you happen to be from the army, or you might provides health problems.

Change your Fees Package

You can consider changing so you can a full time income-driven cost policy for their government mortgage. These preparations legs the degree of their monthly payment in your money plus the size of your loved ones. Otherwise be eligible for an effective deferment or forbearance, it is a good option for your requirements.

Loan Termination

In some cases, you won’t need to repay their federal mortgage. Should your work is how come you don’t have to create money, it is named cancellation otherwise forgiveness. It’s called launch if it is not due to your jobs.

There are many different an effective way to qualify for cancellation, forgiveness or discharge. For example, you could meet the requirements because of where you work (specific schools and you may bodies/nonprofit communities), as you be disabled, or since your college or university shuts.

No Comment