Goverment tax bill With 100percent Bonus Depreciation Becomes A go Inside the Senate

Posts

Point 179 covers the new and put team property, in addition to machinery, place of work seats, and specific software. What’s more, it includes accredited leasehold advancements to nonresidential real estate, for example roofs, Heating and cooling, and security options. Tend to, the same resource tend to be eligible for Part 179 expensing and extra decline.

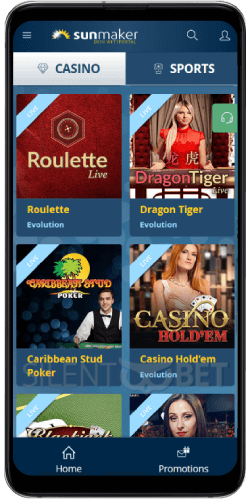

- The rest of so it remark usually look into a long list of BetMGM Local casino’s welcome extra, available gambling games, financial possibilities, respect program, and.

- The brand new depreciation time clock begins not once you purchase the investment however, once you put it in service.

- By far the most accessible versions try greeting incentives and you may reload bonuses.An excellent 100percent deposit added bonus will be claimed from the each other the newest and you can current professionals whenever they proceed with the right steps and you will regard the brand new small print.

- The global lowest taxation is separate and distinct from the brand new business alternative lowest income tax passed as part of the Rising prices Avoidance Act , with no lead effect on added bonus decline as the all expidited depreciation try explicitly created away.

We have been corporation believers from the Fantastic Signal, that is why editorial opinions try ours alone and have not become before examined, acknowledged, otherwise recommended because of the integrated entrepreneurs. The newest Ascent, a good Motley Fool provider, will not defense the offers on the market. It mastercard isn’t only an excellent – it’s very exceptional that our professionals put it to use personally. It have a lengthy 0percent introduction Annual percentage rate several months, a money back price as high as 5percent, as well as in some way with no yearly percentage!

Casino happy hour | Accredited Assets

Full extra decline are phased off from the 20percent each casino happy hour year to own assets listed in services after Dec. 31, 2022, and ahead of Jan. 1, 2027. There’s already 100percent bonus decline to have fixed assets purchased and you can place in service in the season, no matter their prices. Beginning in 2023, the newest restrict creeps off by the 20 payment points a-year, to help you 0percent in the 2027. The fresh phaseout away from completely bonus decline, arranged to take place following the prevent away from 2022, increases the fresh just after-taxation price of financing in america. And make 100 percent incentive depreciation permanent could have additional affects round the opportunities. Such, we discover your farming and you will utilities, a property, suggestions, and you may transport and you can warehousing sectors would have the greatest lack of corporate income tax debts as the a portion of income inside the 2023 and 2032.

Area 179 Small company Expensing

Financing financing is vital to own monetary development, and ultimately, funding investment benefits specialists. Money range regarding the effortless, for example a hammer, for the complex, for example a good semiconductor foundry. The current You.S. income tax password, however, are biased up against investment funding as well as the bias is defined to become worse over the next a decade. If you’d like far more from your playing class and you can aren’t afraid to work a little more difficult for it, you will find popular options, such a 150percent gambling establishment incentive, 200percent gambling enterprise incentive , 300percent local casino bonus, 400percent gambling enterprise extra or 500percent gambling establishment added bonus. Certain casinos drastically limit how many titles you to amount for the wagering, that is difficult — specifically for a new player, thus be looking for it aspect. Read the list of gambling games which might be qualified to receive the advantage plus what percentage.

Including, a casino you are going to match your earliest deposit from the 100percent, atart exercising . quicker percent (elizabeth.g. 50percent, 75percent) for your forthcoming a couple of places to the program. Its Controls out of Rizk is yet another talked about element, where players can be spin the new controls to achieve fascinating benefits out of jackpots so you can totally free spins. The greater amount of you put, the greater you can utilize level up, giving you usage of the newest and better awards.

One of those things is the conclusion away from online working loss , charity contribution, or credit carryforwards. In which Sec. 179 expensing will be the better choice.A corporate that is eligible for eitherCode Sec. 179expensing or 100percent added bonus decline underCode Sec. 168should consider using the brand new expensing option to bring another pros. The bonus cash is usually paid on their own from your real-currency put, so that you’re also able to invest finances equilibrium earliest, and now have a second chance to allege the newest a hundred gambling enterprise extra for individuals who’ve joined a loss. 7024, theTax Recovery to own American Household and you will Pros Work away from 2024, which has 100percent bonus depreciation, along with lookup and invention expensing and you will a growth out of the child Income tax Borrowing from the bank.

Time Gambling establishment

To possess commission steps, Rizk brings a lot of quick and you can smoother choices, as well as bank cards, lender transmits, and a variety of age-purse possibilities. The latter is actually an especially common strategy because enables instantaneous places and distributions if you are securing debt suggestions. Investment news and you can business investigation to your shared money, ETFs, holds and alternative opportunities and you will tips on actions needed to create successful portfolios. Abreast of pressing which switch, you might be redirected to your selected casino site where you is also check in another account. Make certain you currently have your own indentification file with your, as you will need it next phase of your membership procedure.

Mount A keen Election Not to ever Play with One Added bonus Depreciation

During the 2 per cent rising cost of living, the corporation create deduct only six,900 of one’s very first money rates across the lifetime of the newest money in the establish really worth terms. This is step 3,a hundred less than the real 10,one hundred thousand prices, which means that in the genuine terminology, the business’s payouts is exaggerated, resulting in a high income tax load. Thus, the fresh time from will cost you things in order to organizations because they build behavior from the whether to invest. Qualified property to own incentive decline generally tend to be the fresh and you will utilized assets that have recuperation attacks away from two decades or shorter.

They have been white paperwork, authorities study, brand-new reporting, and you may interview with skillfully developed. I as well as reference unique lookup from other legitimate publishers where compatible. You can discover a little more about elements we pursue within the creating direct, objective posts inside oureditorial coverage. The newest asset’s base is not decided inside the mention of the a basis obtained out of a great decedent. The newest asset’s foundation is not figured inside mention of the adjusted basis of the property when less than control of the merchant.

You can find around three additional first year depreciation deduction elections. A great taxpayer is also choose not to ever deduct the excess first year depreciation for everybody qualified property that’s in the same category from assets and you may placed in service from the taxpayer regarding the same income tax year. Minnesota doesn’t follow the newest Tax Incisions and you can Work Operate provision that provides an excellent 100percent very first-year deduction for the modified basis invited to own licensed assets gotten and you will placed in provider immediately after Sep 27, 2017, and ahead of January step 1, 2023. Taxpayers must create right back 80percent of one’s federal depreciation added bonus in order to its Minnesota go back in the 1st year and 20percent of the brand new include-straight back amount will likely be subtracted within the each of the next four decades.MOYes.

No Comment