What exactly is something special page for home financing?

You can have a tendency to fool around with gift funds from a fair provider to help to make a downpayment or pay closing costs when you pick a house. Your own financial will in all probability require you to offer proof of the fresh new current during the a page finalized by the donor.

The goal of this letter is always to file your money doesn’t need to getting paid additionally the donor’s label, contract information, and you may relationship to your.

You can find limitations to the who will present present funds. You can generally use-money from family. Some financing apps can get allow you to use-money of organizations and you may regulators applications, as well.

Family members otherwise people who have intimate household members ties for your requirements usually can offer provide https://paydayloanalabama.com/leeds/ loans to help you pick property. These folks is linked to you because of the blood, relationship, otherwise use. Guardians, home-based lovers, people you want to ily-such as for instance dating (such as for instance a person who you think of a keen sibling, even if you are not related) can be essentially bring current money as well.

A couple of times, you can use funds from an authorities institution, non-cash neighborhood, spiritual organization, or your employer to help with a home purchase. You’ll be able to fundamentally use money you have acquired as a wedding or graduation gift.

You can find guidelines one determine how of course, if you obtain so it money to make it permitted be used due to the fact provide fund. Ask your lender just how this type of regulations could affect you.

How much cash might you be given?

Around are not always constraints how much currency a man otherwise an organisation can supply you with buying a property. But not, financing software will want lowest debtor contributions having purchases containing merchandise. Ask your bank exactly how these guidelines could affect you.

So why do you desire a home loan provide letter?

Lenders need certainly to file one to people current funds you utilize to get a home are not that loan that should become reduced. This is very important since when loan providers is determining even though so you’re able to approve the job, they want to be aware of the cost of all your valuable month-to-month loans costs, not simply their mortgage repayment. Brand new gift page verifies that the currency your acquired isnt a personal debt.

Brand new page will be believe that the individual providing you with the money is not delivering some thing of value inturn, particularly a possession stake in the property. New page should state this new donor’s title, address, contact number and you can link to the fresh new debtor. The brand new current donor is almost certainly not men otherwise organization which have an interest in new product sales of the home such as the seller, real estate agent, creator, or developer.

Their bank can get cost you a lot more documents towards gift, for example bank comments, copies of your own gift check, or wire import confirmations.

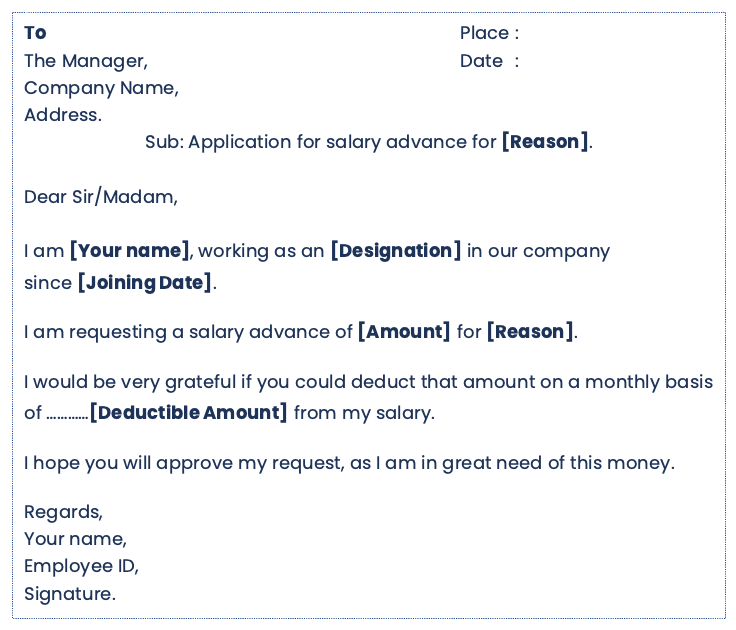

Shot current letter to own a home loan

We, [Donor's Name], in the morning providing [The Identity/Names] the degree of due to the fact a gift for use towards purchase of a property from the [Address].

We claim that which cash is a gift, and therefore zero installment is needed or expected. I’m making this gift exclusively for the purpose of assisting [Their Term/Names] into the to shop for property.

I approve I’m new judge holder ones funds and you will feel the legal right supply these to [Your own Title/Names]. This money cannot come from a loan.

I also approve there are no standards or obligations attached compared to that current, and that it are non-refundable, non-transferable, and no desire is payable.

[Your Label/Names] intend(s) to use this provide on the acquisition of property, and also the fund is utilized simply for new down-payment or settlement costs of the home.Must you spend taxes to your present currency?

Zero. You usually do not need to spend taxes into the hardly any money obtain because the something special. The individual providing the bucks may be needed to invest taxation in it, depending on how much they supply of course they supply it. If you’re considering and come up with something special so you can a family member to assist them to get property, consult a taxation professional to better comprehend the taxes you can even need to pay.

No Comment